Amazon Upgrades Visual Search, LSA Ad Confusion, Data 'Delete Act'

Amazon Search Upgrades Answer Google

Amazon dominates product search. And Google has been battling back for several years with a range of strategies and tactics: more product results, visual search innovations and local product inventory. While Amazon was an early pioneer in visual search (so was Pinterest), it hasn't done much in the past few years. However, the company just announced new features that partly respond to Google's ongoing improvements in product and visual search. Among them, Amazon introduced the ability to add text to image-based search, like Google multisearch. It also expanded its AR "view in your room" capability from large furniture to "table-top" items, such as lamps and small appliances. And there's a new Find-on-Amazon tool that allows users to take an image and share it with the Amazon app, which will find it on the site. Google Lens offers similar functionality. These innovations will probably generate more searches and more ad impressions accordingly.

Our take:

- Amazon's share of US e-commerce is probably between 50% and 60%. That's due to multiple factors: selection, Prime, consumer trust.

- Amazon probably doesn't need to match every Google visual search feature to maintain its product-search dominance.

- However, these tools are likely increase search volumes and boost purchases incrementally and, perhaps more importantly, ad revenues.

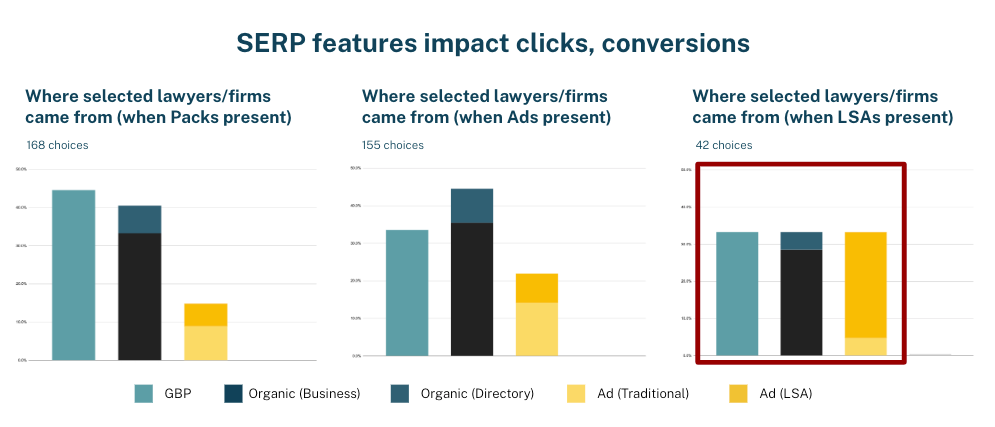

LSAs Don't Look Like Ads

Local Services Ads (LSAs) launched in 2015 and have steadily expanded to more categories and geographies. As of Q1 this year, LSAs were available in 70 local categories, including home services, professional services, education, dentistry, pet care and others. Google has never publicly released LSA performance data. But the program wouldn't have continued if it weren't doing well. Near Media's research in the legal vertical recently uncovered just how well LSAs "work," when they appear. In our research, LSAs appeared in localized search results – SERPs with Local Packs/localized organic – 22.7% of the time. By comparison, Google Ads (any type) appeared in roughly 72% of SERPs. When LSAs were present they not only drove clicks but conversions. (We asked searchers to indicate which lawyers they would ultimately choose.) Indeed, LSAs were as effective as GBP and organic results. (As an aside, I have not been able to find any LSAs in the wild today, in any category.)

Our take:

- Watching and listening to users search made clear that part of LSA's success is frequent user ignorance of the fact that these are ads.

- LSAs contain images, Google badges and reviews. They're formatted differently and don't look like conventional Google Ads.

- LSAs have a growing review spam problem. And Google apparently doesn't police LSA reviews as they do organic reviews – strangely.

'Delete Act' Could Kill Third Party Data

California legislators have passed Senate Bill 362, the so-called Delete Act. It now awaits Governor Gavin Newsom's signature but he has not indicated whether he'll sign it. The law creates a kind of "one stop shop" for personal data privacy in the state. It would mandate the creation of a website where consumers could ask all data brokers – there are more than 500 operating in CA – to delete their personal information. Currently California consumers can ask individual sites and ad networks to "do not sell" their personal information but that's a fragmented and cumbersome process. And by all accounts it hasn't worked for consumers. The term "data broker" applies to any business that "knowingly collects and sells to third parties the personal information of a consumer with whom the business does not have a direct relationship." This rule would apply to any business that sells third party data – online or off.

Our take:

- Business groups have lobbied aggressively against the act and warned of unintended consequences such as undermining fraud prevention.

- The law would not affect first party data collection. It would impact ad networks and smaller publishers. Contextual ads would rise.

- We can assume, by analogy to Apple's ATT, that a majority of CA consumers would ultimately ask for data deletion.

Recent Analysis

- Near Memo, episode 127: Google Antitrust case unlikely to change anything, GBP deduping form, searchers go deep in the SERPs.

Short Takes

- Yelp has more even review distribution than Google.

- Google Maps showing a shaded nearby walk zone from location.

- Google expands use of third party reviews on GBP.

- Google starting to roll out SGE to broader audience with pop-up.

- Google to pay CA $93 million for location tracking without consent.

- New Google Helpful Content Update now rolling out.

- TikTok "quietly" showing Wikipedia links in search results.

- TikTok hit with nearly $370M fine in EU for privacy violations.

- Twitter/X CEO Linda Yaccarino builds her team – it won't matter.

- Can AI help bring back ad spending to news sites?

- AI prominent in Apple's new offerings; they just don't call it that.

- Instacart no longer a delivery service, it's an ad platform (NYT).

- As US dithers, EU takes global leadership on regulating tech and AI.

- Beyond VR: Meta brining "metaverse" to mobile, web.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.