Why Google Lost Product Search, Shopify vs. Amazon, Smart Speakers Flatline

Why Google Lost the Product Search Battle

For at least five years consumer surveys have repeatedly told us that Amazon dominates product search. Different surveys have different numbers: the range is 46% to 74% who start their shopping research on Amazon. Google has responded with a full-court press to regain market share. A key element of that is showing both e-commerce and local-store inventory options to users, which is a smart strategy. But Fabric CEO Faisal Masud, who previously worked at both Google and Amazon, offers a in-depth analysis of why Google is losing to Amazon and why it's unlikely to catch up. He also says Amazon is on the cusp of duplicating Google's mistakes. Below are a few additional points.

More from the article:

- Google stuffing more ads into SERPs has caused them to be less valuable and relevant to users. Amazon has benefitted.

- Amazon offers a more relevant and better on-site user experience than Google does or can. This is contributing to a migration of ad dollars.

- Amazon's ads push and manipulation of SERPs to promote its own products risks alienating users. But it's too late for Google to win now.

Shopify Inches Closer to Being Amazon Challenger

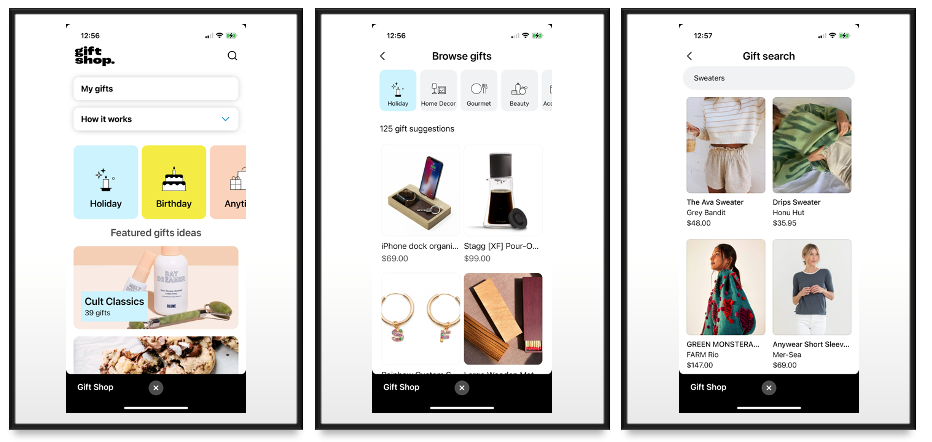

Shopify has stayed away from head-to-head competition with Amazon, although it's flirting with that now. It has been an e-commerce platform enabling online selling (mostly for SMBs). Shopify also has a growing roster of top-tier distribution partners, including Google, Facebook and TikTok. However, in April, 2020 the company launched its first consumer app, called Shop. The user experience was poor, but has since improved somewhat. The company recently launched Gift Shop (curated product collections) within Shop. It has also improved product search. These moves suggest Shopify could become a more direct Amazon competitor soon. It's approaching 2M merchants.

Our take:

- By not being a consumer site in the past Shopify has had a clear focus on its merchant base; there was no confusion about who the "customer" is.

- The move to become a shopping destination is logical and even perhaps inevitable as the company helps merchants with product discovery.

- If Shop evolves a great UX, it could become a viable Amazon challenger in some categories.

Smart Speakers: Amazon Has Won, So What

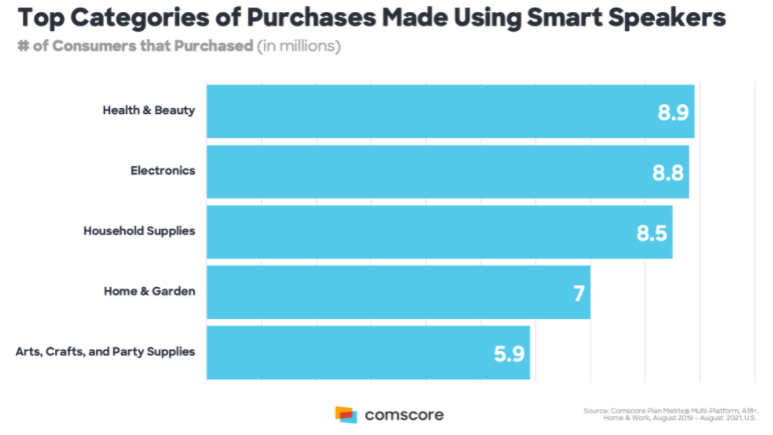

There are roughly 250 million adults in the US out of a total population of 331 million (2020 census). There are also about 153 million smart speakers in US households. In addition to delivering music, news and the weather, smart speakers have become smart-home controllers. According to Numerator, about 73% of US adults are using Amazon Echo/Alexa for for that function (vs. 24% using Google). Yet these devices have flatlined as search/e-commerce tools. Mysteriously, surveys continue to show otherwise. For example, comScore says millions of people are "making purchases" using smart speakers. And 2021 consumer survey data from Uberall reported 27% of more than 1,000 US respondents having "completed a transaction on a smart speaker." I can't explain those results but they don't represent what's really going on IRL.

Our take:

- The smart speaker was envisioned as new search and e-commerce platform, especially by Amazon. That has failed to materialize.

- Bloomberg reports, consumers are losing interest in Alexa and Amazon is losing money on them. Limited UX and privacy issues are partly to blame.

- While the smart home market will continue to grow, smart speakers are a disappointment. It's not clear what would change that.

Recent Analysis

- ICYMI: Google Plays Catch-up to Amazon in Product Search, by Adam Dorfman

- ICYMI: Local Search Ranking Factors 2021: What's New?, by Greg Sterling

Short Takes

- Moz: Local SEO success factors for 2022.

- Yoast launches SEO app for Shopify users; $29 per month.

- Amazon, Google, FB scaring SMBs into lobbying for them.

- Instagram brings back non-algorithmic chronological feed.

- Walmart to expand in-home delivery from 6 to 30 million US homes.

- On January 19 Facebook will nix ad targeting related to "sensitive topics."

- Google showing more web stories in top news carousel.

- AI infiltrating ad creative for better and for worse.

- Fintech startup Bolt to make 4-day week permanent after trial.

- Sony introduces two new EVs at limited-attendance CES.

- Facebook abandons its "XROS" project (for now), will rely on Android.

- Fanatics buys Topps: Get ready for the NFT-ification of baseball cards.

- Opinion: How the metaverse can right past social media wrongs.

- Another antitrust suit aims at Apple-Google mobile search partnership.

- COVID forces Macy's, Walmart to close locations and cut some store hours.

- Following other retailers, Best Buy launches an in-house ads business.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.