Apple Opt-ins, Cash Is Sinking, CPSC vs. Amazon

What's Really Going on with IDFA?

There's a lot of conflicting information about Apple's AppTrackingTransparency (ATT) and the number of opt-ins. According to Flurry Analytics, it's either 14% or 6% of US users who have opted-in to be tracked. AppsFlyer contends the rate is a much higher 37%. Branch claims it's 25% saying yes. At this point roughly 70% of iPhone users are now on iOS 14.5 or above. Some advertisers are seeing revenue losses of 15% - 20% or higher. One mobile analyst called it "pretty devastating...for the majority of advertisers." Yet other reports suggest the impact is limited. One location intelligence company I spoke with told me that they've seen almost no loss of iPhone IDFA data available to them. Confused?

Our take:

- The "real opt-in number" is probably 20% - 25%. It will vary by category and even more by app publisher.

- It's difficult to explain why some advertisers are "devastated" while others appear not to be very impacted. We need to see more data.

- Developers will get smarter over time in their pre-prompt messaging to boost opt-in rates. In the interim ad spend is shifting to Android.

Mobile and Card Payments Rise, Cash Sinks

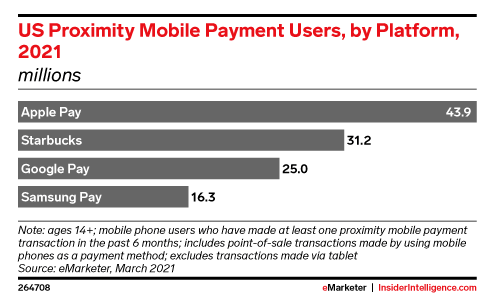

One of the underreported stories of 2021 is the mainstreaming of mobile and contactless payments. According to NielsenIQ research, "60% of contactless payment users used a contactless payment service for the first time in the last 6 months." While COVID was the driver for many consumers and retailers, other values will keep it going. For example, a recent Uberall survey found 72% of US consumers think accepting Apple Pay or Google Pay is "very" or "somewhat" important. And 34% said they would be more loyal to stores that did. Amazon will be using "just walk out" payments in its Amazon Fresh grocery stores. Axios reports on a parallel development: the disappearance of cash, now down to less than 20% of transactions. Cash is increasingly used for "off the books" purchases. The evidence: $100 bills are 80% of paper money in circulation.

Our take:

- Cash isn't going to disappear but it will be increasingly marginalized and people paying with it potentially stigmatized (e.g., poor/unbanked).

- Consumers like "Scan & Go" and "Just Walk Out" options. Retailers will embrace them for competitive and cost saving reasons.

- There are nearly 10 million cashiers in the US; expect half those jobs to disappear within 10 years.

CPSC to Amazon: 'Accept Responsibility' for Products

This week, the US Consumer Product Safety Commission (CPSC) filed an administrative complaint against Amazon, seeking recall of "hundreds of thousands" of dangerous products on the site. It wanted the company "to accept responsibility" for the hazardous products. Amazon told NPR that it already removed most of the identified items and provided refunds. While this is not a Section 230 issue – defective products are different from "content" – it's somewhat analogous. Section 230 of the Communications Decency Act currently shields online platforms from liability for the content on their sites. Amazon doesn't want to be held responsible for third party sellers' products.

Our take:

- The major digital platforms have historically been lax about policing destructive/fraudulent content. Things have improved recently.

- Facebook is often singled out for resisting action against pernicious and deceptive material (e.g., "stop the steal," anti-vax) on the site.

- An emerging regulatory battle (Section 230 reform) is about getting tech companies to police ("take responsibility for") the content on their sites.

Recent Analysis

- Change Is Afoot at the Newly Revitalized FTC, by Mike Blumenthal.

- ICYMI: Local Listings Domino Theory, by Andrew Shotland.

Short Takes

- Crew acquisition helps Square move further beyond POS.

- Google now allows deletion of last 15 minutes of search.

- Google's results for the same queries vary wildly by country.

- Google Ads Optimized Targeting rolling out, will be default-enabled.

- MozCon Virtual day 3 recap blog post.

- Dollar General adding 1,050 new stores, to hire 50K employees.

- June US retail sales up 18% vs. 2020, 0.6% sequentially.

- Retail stores packed with "unchecked" facial recognition tech.

- Digital privacy increasingly has become a class marker.

- Companies must honor CCPA opt-outs sent through GPC.

- Surgeon General: big tech must fight COVID misinformation.

- White House taking steps against ransomware attacks.

- Local news losing billions to major tech platforms, says report.

- VR content revenues growing faster than other media segments.

- Watson may finally turn into a business for IBM.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.