Prime Day Billions, Value of Stores, Disabling Location

Amazon Prime Day Sales May Reach $11B

Last year Amazon Prime Day generated almost $10.5 billion in sales. This year should beat that, although Prime Day won't benefit from proximity to the holidays. Despite this, Adobe projects Prime Day (today and tomorrow) will overtake 2020's CyberMonday's $10.9 billion total. According to Numerator, the average sale value is $46.88; the top-selling item is Amazon's Echo Dot. There are roughly 147 million Prime subscribers (US) helping make Amazon the US's largest e-commerce company – with more revenue than its next nine competitors combined. The Seattle company is on track to overtake Walmart for total sales next year, according to a projection by JP Morgan. Some retailers (e.g., Target, Walmart) are competing with deals, others are more nonchalant.

Our take:

- Amazon has established CX/UX standards other retailers and small businesses must increasingly conform to in order to compete.

- Most consumers would probably argue Amazon has been good for them. Most aren't aware of its impact on local businesses and workers.

- Despite ethics, consumers are hooked: the top 3 reasons for shopping Amazon are: 1) fast/free shipping 2) product selection 3) price discounts.

Stores Critical to Brand Building, Customer Acquisition

Online retailers are feeling a dual pinch: rising social media costs and increasing privacy constraints that make online marketing more challenging. To some degree the two are related: Apple privacy moves are helping drive up Facebook ad costs. DTC brands in turn have branched out in search of cheaper online impressions and clicks. It's also causing some brands to reconsider traditional media, which are more affordable these days. Stores are also an answer to rising customer acquisition costs. That's one reason DTC brands have been moving offline, opening stores (e.g., Glossier). Stores also help build brands: online shopping tends to erode them, as more choices are considered during pre-purchase research.

Our take:

- According to multiple data sources, in-store shopping has largely returned to pre-COVID levels – although I have some skepticism.

- Google's first true retail store opened last week in NYC. It could significantly boost awareness of Google's products among consumers.

- Target continues to evolve and invest in its stores, which are instrumental to the success of its e-commerce strategy.

Consumers Protect Privacy by Disabling Location

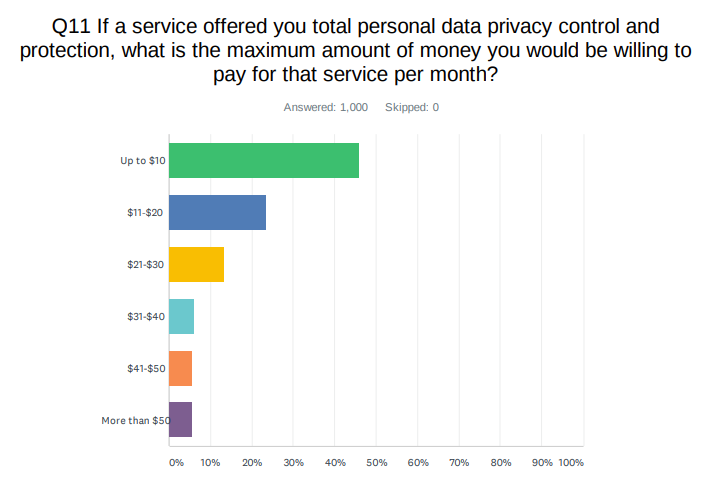

A new survey of 1,000 US adults from Adswerve finds that 91% of consumers want more control over their personal data. Asked how informed they were about online privacy, 67% estimated: extremely or somewhat. Yet 61% acknowledged not being able to "generally explain" GDPR or CCPA. Disabling location information/tracking was the top way consumers protected their privacy. That was followed by use of VPNs and incognito browsing. Some claimed to have stopped using Facebook (30%) and Instagram (21%) because of privacy issues. Nearly half (46%) were willing to pay up to $10 per month for personal data control. Another 36% would pay between $11 and $30 monthly. Roughly 68% were willing to accept payment in exchange for their data, but 32% said "no amount of money could buy all my data."

Our take:

- Here's yet another survey reflecting growing popular concern about privacy and control over personal data – 91%.

- Ads or content personalization are not sufficiently motivating for tracking opt-ins. People want concrete value (deals, direct payments)

- Yet Apple won't allow developers/publishers to offer concrete incentives or rewards for opting-in to tracking. This is a major challenge.

Recent Analysis

- Near Memo Episode 20: Google's content expansion, local search and transactions, market consolidation and antitrust.

- Google's Online Food Ordering Is the Future of Local Search by Mike Blumenthal.

Short Takes

- The US economy is never going back to "normal."

- Customer service is main goal of engaging with brands on social media.

- Google now showing only two FAQs per rich search result.

- Sorry Peleton: As gyms reopen, people buying less home exercise gear.

- Amazon continues fake reviews crackdown, by removing products.

- Hotel bookings now exceed 2019 levels, though flights are still down.

- Survey: Hate speech on social worse than profanity.

- Local journalism model: No ads, non-profit and online only (NYT).

- Uber buys remainder of grocery-delivery startup Cornershop.

- Data centers compete for water in drought-stricken areas.

- Unions and SMBs may align to fight big tech such as Amazon (NYT).

- New US broadband map shows gaps in high-speech internet access.

- New momentum for the four-day work week.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.