Google Trial, SMB AI Hopes, Yelp's Ad Revs Up

Google's Antitrust Trial Set

Earlier this week, a California judge denied Google's summary judgment motion in the $5 billion Chrome "incognito" browser tracking lawsuit. This doesn't mean Google will be held liable at trial but it's a significant setback for the company. In a separate antitrust case, Google had both a setback and major victory. The DOJ and state attorneys general separately sued Google in 2020 (the cases were combined). Collectively they argue Google has a monopoly in consumer search and digital advertising. There were also other claims, among them that Google favored its own content in SERPs (e.g., Local/Maps). Ruling on Google's summary judgment motion, federal judge Amit Mehta eliminated a number of claims related to digital advertising and self-preferencing in a significant victory for the company. However those claims arguing that Google default search deals (worth billions) and pre-loaded Google apps on Android are anticompetitive will go to trial on September 12.

Our take:

- Consumers click (or zero-click) at least as much on Local Pack results as organic. Thus it does disadvantage competitors as a practical matter.

- Google will argue at trial that nobody is obliged to use its search engine and "competition is just a click away." In reality, the default search deals helped build and maintain Google's dominance and ad revenues.

- This is the biggest antitrust trial since Microsoft in the late 1990s, which Microsoft settled to avoid a divestiture. Google's odds are 50-50.

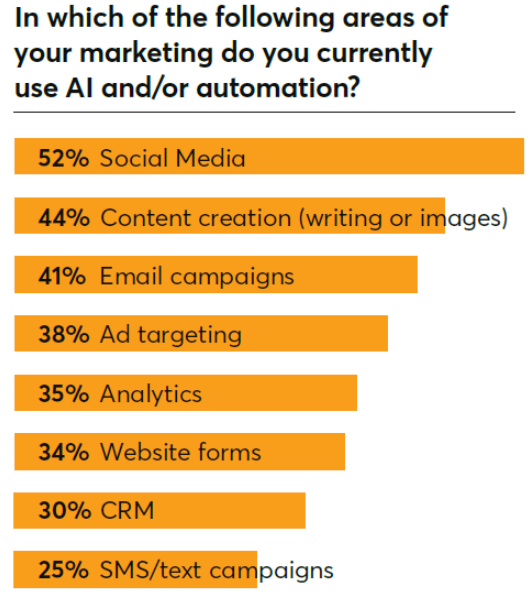

SMBs Have High Hopes for AI

While most consumers in the US are quite anxious about AI, small businesses (SMBs) appear to be bullish about the technology. A new survey from Constant Contact, conducted by Ascend2, trumpets the value of AI for SMBs. The headline is "91% of small businesses who are currently using AI say it has made their business more successful." However, "success" isn't defined and a closer look reveals that only 26% of respondents are actually using AI tools – that's 126 SMBs out of the 486 surveyed. Most of the survey is focused on time and cost savings from AI usage. About 90% of SMBs (113) using AI are saving an hour a week or less. Those same business expect to save $1K in the next year using AI/automation. Among those currently employing these tools, top use cases are social media (52%), content creation (44%) and email marketing (41%). Data security, cost and the learning curve are the biggest barriers to adoption according to the survey.

Our take:

- Tools that are time and/or labor saving are especially useful to time-starved SMBs at the lower end of the headcount spectrum.

- Most AI exposure SMBs have is to ChatGPT/Bard or through their software vendors, which are integrating it (e.g., Constant Contact).

- AI/automation will be present in all SMB-SaaS tools. And while they can deliver efficiency and insights, they can't substitute for strategy.

Yelp Success: More Clicks, Higher CPCs

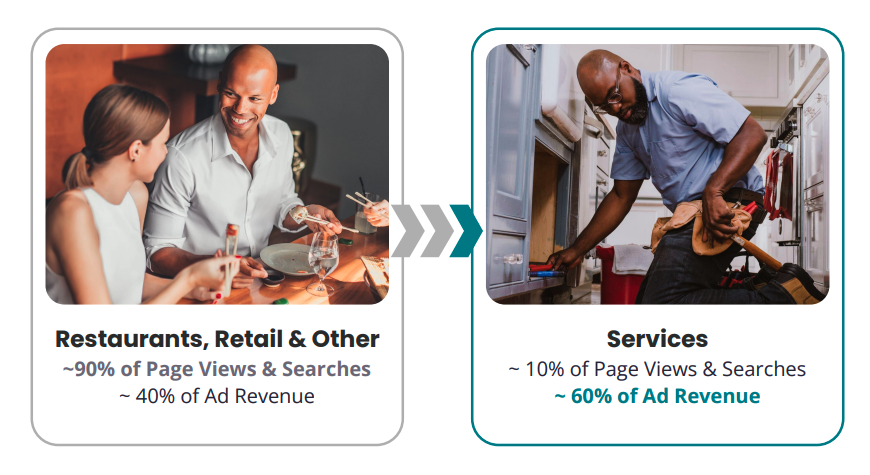

Yelp has quietly been beating Wall Street Expectations for the past several quarters. Last week it posted 13% YoY revenue growth, the same as in Q1 – also beating expectations. Revenue was $377 million, while income grew 84%. This was "the ninth consecutive quarter of double-digit growth." Yelp said that "self-serve and multi-location accounted for more than half" (51%) of ad revenue for the first time. Most of the growth is coming from higher revenue per location (increased prices/share of wallet) rather than advertiser numbers: "paying advertising locations were relatively flat, down 1%." CPCs grew 14% YoY and there were more more ad clicks. Growth came in the Services/Home Services, Restaurants and Retail categories. However Yelp said its request-a-quote submissions were down 10%, which it attributed to the economy. Yelp highlighted store visits attribution as a key to its multi-location ad growth. The company claims 6.3M "active local business" locations and 73M monthly users. Consumer traffic appears flat.

Our take:

- 60% of revenue is coming from 10% of searches/views (services). Seeing Yelp as a home services platform, one investor is advocating a merger with ANGI.

- Yelp's brand is strong in some categories (i.e., services, restaurants) but not in others (e.g., healthcare) and it heavily depends on Google SEO.

- The story is one of efficiency as Yelp extracts more money from existing customers; it's not really growing users or unique advertisers.

Recent Analysis

- How to Use Google's New 'Image Not Approved' Appeal Form, by Mike Blumenthal.

- Near Memo episode 122: New local ad format, updated GBP Guideline clarifies policies, Google SGE shows reference links.

Short Takes

- Google now showing more links in SGE local results.

- Google adds "from Google" card to SGE AI carousels.

- Google: FAQ and How-To rich results mostly going away.

- Moz introduces new brand (not domain) authority score.

- Google publishes new Responsive Search Ads guide (.pdf).

- Google wants robots.txt type approach to AI data mining.

- Nextdoor announces small gains in Q2: 42M weekly users (up 13%).

- Colgate using gen-AI to optimize 1K product detail pages.

- After backlash, Zoom says it won't train AI without user consent.

- DoorDash is winning the food delivery race in North America.

- In Europe, personalized ads will mostly go away on TikTok.

- WeWork may not survive another year.

- SMBs were responsible for 73% of July job gains.

- SMB outlook improves (except VSBs), but hiring still tough.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.