SanFranciscoGPT, IBA vs. Contextual, Twitter Survival

SanFranciscoGPT

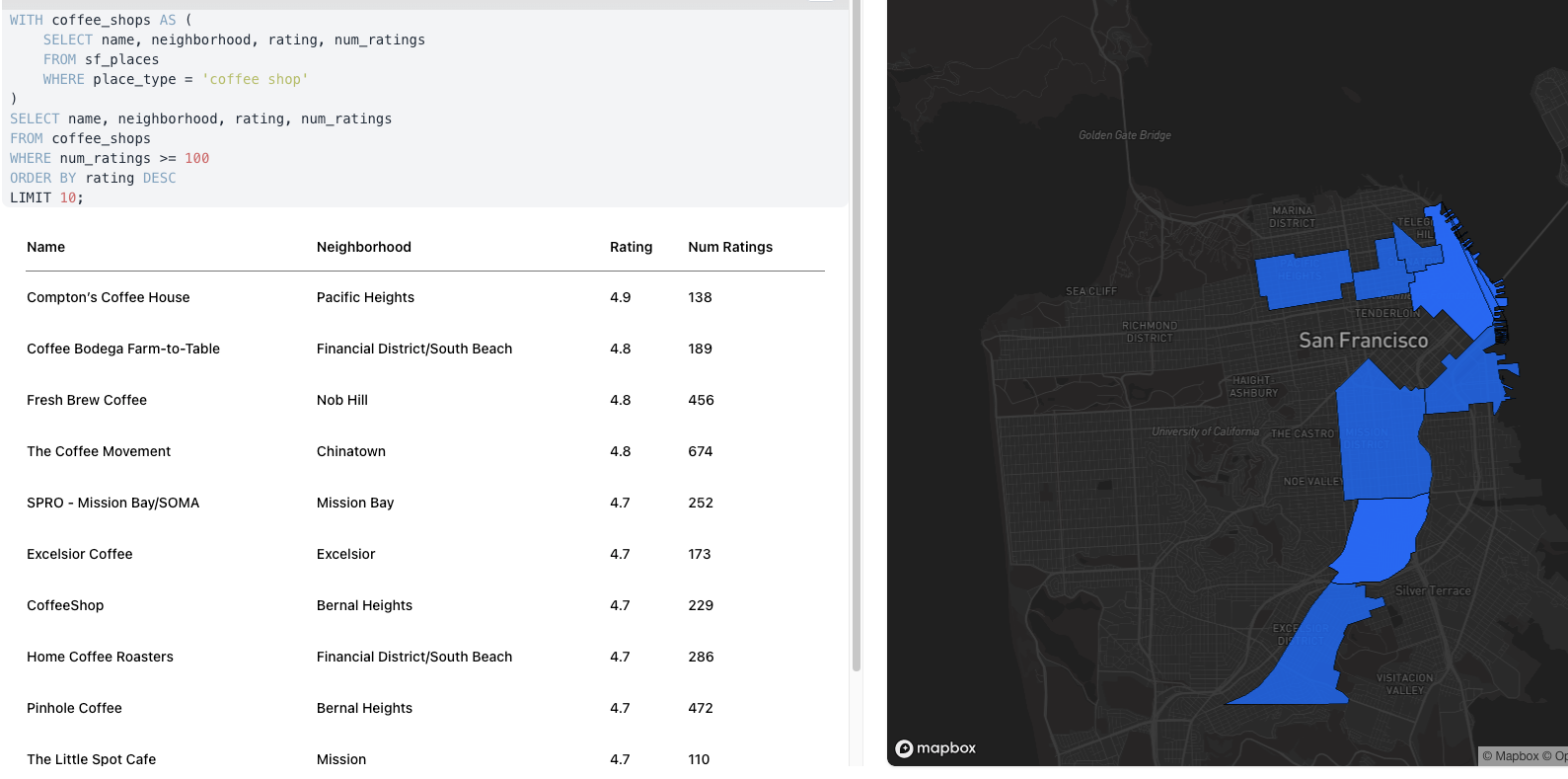

At Near Media, we don't equally agree on how disruptive AI will be to local search. I'm probably the most bullish of the three of us on GPT-style interfaces and their potential to change search, while David believes the current local SERP is much more useful than a chat-based UI. Enter SanFranciscoGPT, a local version of CensusGPT, which taps into databases about neighborhoods, demographics, crime and other public data. One of the featured queries is "Show me the locations of the 10 highest rated coffee shops with at least 100 ratings." It's incomplete and very rough around the edges. But SanFranciscoGPT points toward AI's potential to offer a simpler and more efficient local search experience. It's only a matter of time before someone launches a more elegant execution of this idea. There could be a version of SanFranciscoGPT for every major metro in North America. Yet there are barriers to success, including data depth, quality and accuracy.

Our take:

- In the early '00s it wasn't clear search could compete with directories, which had rich local business data. Google overcame that issue.

- Many people will still prefer the visually dense local SERP we've become accustomed to. But there's an opening for GPT in local.

- As discussed, there are vertical sites/engines/directories now incorporating AI. They also have an opportunity if they can pull it off.

Google IBA vs. Contextual Targeting

Google revealed the results of its latest interest-based audiences (IBA) test, seeking to reproduce cookie-based tracking and targeting – without cookies. Google said results were nearly as effective as cookie benchmarks: "click-through rates remained within 90% of the status quo." Conversions, using proxy metrics, were down 1% to 3%. Google celebrated these results as "promising," while others have characterized them as "meh." Google also said that AI-powered optimization reduced the impact of removing cookies. The company has twice delayed its deadline for Chrome cookie deprecation. It now stands at Q3 2024. Google's post-cookie targeting relies on a mix of data and signals, including context. But it would be very interesting to see how straight contextual targeting compared to Google's IBA. Multiple studies argue that contextual targeting is more cost-effective per conversion than audience targeting (here, here, here, here).

Our take:

- Contextual targeting solves multiple problems, including privacy and brand safety. Reach might suffer, but efficacy doesn't seem to.

- Ad platform vendors can command higher CPCs with personalization and audience targeting (e.g., location, behavioral signals).

- Google's solution combines audience and contextual targeting. Google likely wants to retain personalization because of higher CPC revenue.

What's Keeping Twitter Alive?

People keep anticipating Twitter's demise. Almost every other day there's an article proclaiming its brokenness, boringness, financial decline and ruin. But it continues along, albeit in diminished form. (The company also faces billions in potential fines in Germany for failing to take down hate speech.) I haven't seen any surveys, but my sense is that other than among die-hard Elon Musk fans and acolytes, there's pent-up demand for a real alternative. And therein lies the problem. There's no competitor with sufficient critical mass to prompt widespread defections. Mastodon initially appeared to be one. But it has recently lost momentum and users. There are various other contenders and would-be Twitter replacements, including Post, Bluesky, T2, Substack Notes and others. But people either don't know about them, don't have access or don't want to invest effort in yet another platform unless it's going to pay off. So they remain on Twitter – for now.

Our take:

- One question: why hasn't LinkedIn become or created an alternative? It has to do with the LinkedIn culture and its bulky UI.

- Twitter's subscription revenue opportunity seems to top out at ~$40 million (vs. ~ $5 billion in 2021 revenue). Ads will continue to decline.

- Now worth less than half what Musk paid for it, Twitter probably continues its slow decline (absent big changes) until a true alternative emerges.

Recent Analysis

- Near Memo ep. 109: Google’s Online Local Ads, Bard and local SEO, impact of chat on the future of local search.

Short Takes

- Opinion: Local SEO dead in competitive categories.

- Low-code tools improve marketing outlook for SMBs.

- GBP Manager bug hiding some business listings.

- Google showing shipping and returns information in SERPs.

- Yelp wants to kill employee non-competes.

- Google AR-related coupon clipping feature in SERPs.

- Google rush to launch Bard caused "ethical lapses."

- AI-generated Drake-Weekend collab viral before crackdown.

- Photography competition winner AI, not actual photo.

- Apple to allow "sideloading" apps in EU.

- Square launches barrage of new features for SMBs.

- SMBs priorities, outlook different by cohort, industry.

- Prevalence of remote work by industry in US (2021 vs. 2022).

- FTC readies crackdown on false/exaggerated product claims.

- Netflix finally shuttering its DVD mail business.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.