Plug-in Search, Local Merch Returns, Privacy Paradox

Plug-ins and Personalized Search

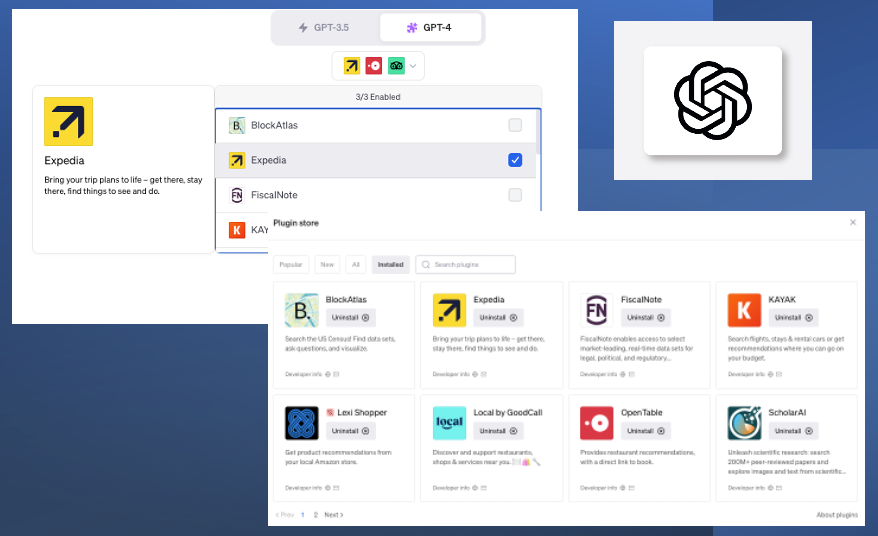

Before Apple bought Siri in 2010, its CEO Dag Kittlaus envisioned his digital assistant eliminating the need for a "middle man" (Google) by linking user requests directly to a data source that could deliver an answer or transaction (e.g., dining reservation via OpenTable). That vision never came to pass because Apple gobbled up the company just two months after launch. But that opportunity is back, in a way, with AI plug-ins (ChatGPT) and extensions (Bard). These are mostly structured data sources that can be selected and turned on or off by the user. Instead of sifting through material chosen by a mostly opaque algorithm, I can personalize my SERP by selecting specific (and potentially more trusted) data sources. In the case of travel, it might be Kayak, Expedia and Tripadvisor. In practice, however, the ChatGPT plug-in experience still has a long way to go. But the potential is there. And if I don't have relevant plug-ins in a given category, web search could always fill in the gaps or backfill.

Our take:

- The opportunity to query a group trusted sources in the same category is appealing. This is superior in principle to a single app experience.

- As I've indicated, there would be a role for OG search in my fantasy of the future, but it would be a very different use case.

- If this came to pass, would it recreate the Google problem in a different form? Would it reduce publishers to data providers? Maybe, yes.

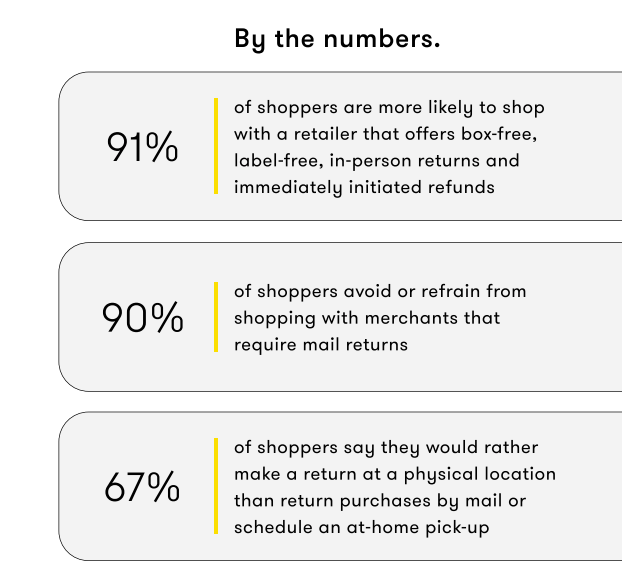

Local Returns Drive Online Buying

E-commerce success increasingly depends on offline returns. Don't believe it? A survey we ran at Uberall (2021) found, "71% of US adults said they were more likely to buy a product online, that they hadn’t seen in person, if they could return it to a local store." That argument is reinforced in a new report, "Returns Happen 2023" (PayPal). Based on a survey of 2,000 US consumers and 200 merchants, it examines the symbiotic relationship between online shopping and local returns. The survey cites skyrocketing e-commerce return rates (often above 20%), which are the likely result of "bracketing": buying with the intention of returning items. In response, merchants have started to push back on high return rates with fees. But that can cost them customers and affects conversion rates. The report also points out that 90% of shoppers want to avoid return shipping and make returns locally. Consumers want those returns to be incredibly convenient – no labels or packing and close to home. The bottom line: return policies (and the availability of local returns) increasingly shape merchant perceptions and the willingness to buy online.

Our take:

- Local returns doesn't always mean same-merchant stores. Amazon offers a range of return locations (Whole Foods, Kohl's, UPS stores).

- Indeed, Amazon spent years developing a local returns network to de-risk online shopping. This removed a big argument against the company.

- The recognition that a merchant with both online and offline assets is more attractive is partly what's driving D2C brands into physical stores.

Privacy: People Concerned, Overwhelmed

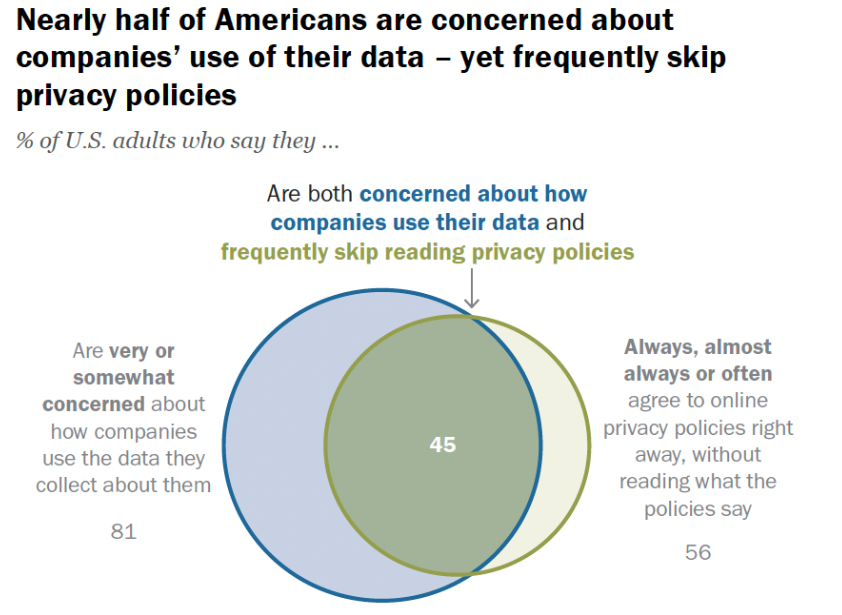

In contrast to Mark Zuckerberg's now infamous 2010 quip about privacy as a social norm becoming less important, privacy has only grown in importance and urgency (think: location data and abortion). In response, the big platforms are now talking more about privacy and offering some user controls. But often these are tough to find and use. And the "we care about your privacy" rhetoric is generally more PR than practice. A new Pew Research study, "How Americans View Data Privacy" explores attitudes toward privacy and adjacent issues (AI). According to the study, 75% of adults trust themselves to manage online privacy. But nearly 60% don't read privacy policies (probably more). Beyond this, people are frequently overwhelmed trying to manage their own privacy and data security. Pew found they're worried almost equally about government surveillance and "surveillance capitalism." They're anxious about their data being sold or stolen, but feel they have little actual control (73%) over how it's used. A majority (72%) support more regulation and don't trust tech company CEOs to be responsible with data. And while people are using a range of tactics – cookie blocking, alternative browsers and search engines, encrypted messaging, etc. – the overall sense is one of fatigue and fatalism, with some differences by age, ethnicity and education.

Our take:

- The graphic captures "The Privacy Paradox": increasing concern but little behavioral change. The enormity of the project creates resignation.

- There's a growing chasm between the tech-industry pseudo-embrace and discussion of privacy and the skepticism of the public.

- There's a lot of "privacy theater" happening, revealed by all the behind-the-scenes industry resistance to concrete regulation and legislation.

Short Takes

- Encore: the Local Business Content Marketing Guide from Moz.

- With other AI tools, Square intros AI-menu generator for restaurants.

- News aggregator Artifact letting people share favorite local places.

- Amazon introduces "Consult-a-Friend" social shopping tool.

- VC: Within 10 years AI will do "80% of all jobs that we know" (WSJ).

- Net neutrality, dismantled under Trump, is back.

- Musk thinking of pulling Twitter out of EU to avoid DSA content rules.

- Google at trial: our search quality not dependent on default deals (NYT).

- All the big AI platforms trained on "stolen" content (WaPo).

- 70% of marketers feel "overwhelmed" by AI development speed.

- Stanford ranking the transparency of AI platforms -- all score poorly.

- 42% of Mac owners use AI-driven apps on a daily basis, says poll.

- Apple patent envisions windowless car using Vision Pro to see outside.

- Amazon to bring drone delivery to 3rd US city, UK and Italy in 2024.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.