Google SGE Pushdown, Siri AI 'Overhaul,' Brick & Mortar Halo

SGE Pushes Everything Else Down

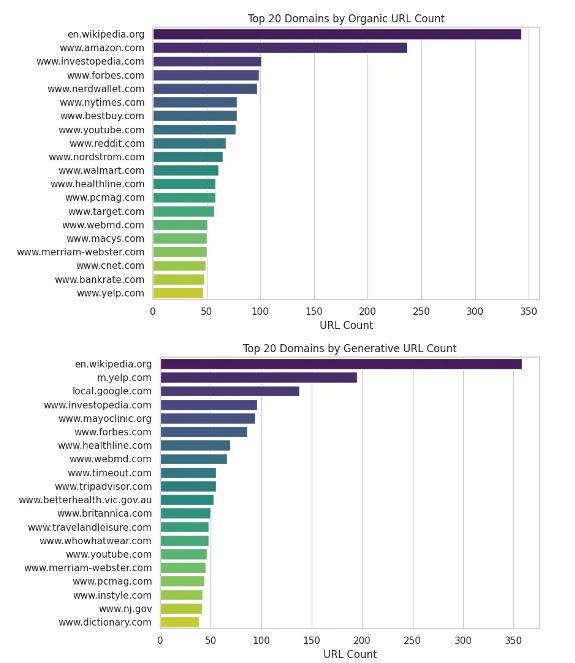

In the first really compelling study of the impact of SGE on the Google SERP, Authoritas examined results from 1,000 commercial keywords in the US. The main conclusion: traffic from top organic rankings will suffer meaningfully if Google more broadly rolls out the current incarnation of SGE. This is widely expected but Authoritas documents how SGE pushes down every other element of the SERP. The study found that SGE showed up for "86.8% of all search queries" but "65.9% of the time" users were asked to "generate" results and "34.1% of the time a pre-populated SGE element appears with a ‘Show More’ link." When users "generate" or "show more," the top organic listings shift dramatically down the page – more than 1,500 pixels. In addition, 94% of the links in the AI snippet come from "outside the top ranking domains." Less than 5% of the time do URLs in SGE "exactly match a URL in the organic results." The average number of SGE links is 10.2, but up to 37 for this data. The following charts show the top organic domains for the keyword set and the top domains appearing in SGE results. Yelp and Google Local appear to be big winners as well as a few other local-intent sites.

Our take:

- One major wildcard is whether users will engage with SGE, especially the 66% of the time that users are required to "generate."

- SGE isn't "fully baked," nobody should panic but SEOs should definitely be paying attention and thinking through scenarios.

- These findings suggest GBP and its various content components (e.g., reviews, images) become even more important in a post-SGE world.

Report: Siri to Get AI 'Overhaul'

Google is poised to lose some or all of its "default search" antitrust case when the US district court court rules on liability later this quarter. (There will be appeals either way.) If so, one potential remedy is the end of Google's default search deals, which would deprive Apple of many billions in revenue but could accelerate an Apple "search engine." Separately, Apple is trying to close its AI deficit and, according to Bloomberg's resident Apple watcher Mark Gurman, the company will introduce "a big overhaul to its digital assistant, Siri" at its developer conference. However, the report adds, the AI-based improvements wouldn't be fully rolled out until 2025. Beyond Siri, Apple plans to incorporate AI features into a broad range of its products. The simultaneous enhancement of Siri with AI and the end of the Google-Apple default search deal may prompt Apple to deliver a better iPhone "search" experience – although it's unlikely to be a search engine per se.

Our take:

- We know from antitrust trial documents and testimony that Google actively tried to prevent Apple from advancing its search capability.

- When Apple introduces substitute offerings (e.g., Apple Maps) it can have a adverse impact on incumbents (i.e., Google).

- Google is not in any danger in the near term but longer term, alternatives may chip away at query volumes around the edges.

Brick & Mortar Halo Effect

Physical stores reduce customer acquisition costs, improve brand trust and loyalty and, perhaps counterintuitively, boost online sales. I've been arguing that last point for almost 20 years in one form or another. And there have been periodic surveys and other evidence to support the idea of a symbiosis between stores and e-commerce. For example, a survey we ran at Uberall found that ~69% of consumers (globally) are more likely to buy something online "sight unseen" if there's a local store for returns. And executives from retailers such as Macy's, Warby Parker and Casper have all spoken about the beneficial impact of stores on e-commerce. But a new report from ICSC shows definitively that "opening a store boosts online sales, while closing one decreases them." Based on an extensive analysis more than $850 billion in local and online spending in the US, across 69 retailers and 2,100 stores in various categories, the study found that opening a store bumped up online sales in that trade area by ~7% to ~14%, depending on the category. Online basket size increased as well. By contrast, after the closing of a physical store, retailers on average saw a nearly 12% decline in online sales. These findings fly in the face of much of the digital marketing world's casual assumptions about consumer shopping behavior.

Our take:

- Closing a local store, in many categories, can dramatically impact overall spending (online and off) by consumers. For example, "Home stores suffered a 59.3% drop in total spending" after a local store closing.

- Yet where there's strong brand loyalty, in selected categories (e.g., cosmetics) online sales increases may occur and mitigate some of the damage.

- GenZ is the cohort that is most interested in shopping in stores, although "in-store is the preferred channel for all generations," according to the report.

Recent Analysis

- Near Memo episode 140: Businesses & Google SGE, Google Goes All in On Interstitials, Where is Bard Going?

- Google LSAs Supercharge Duct Cleaning Scam, by Mike Blumenthal.

Short Takes

- Websites made with GBPs no longer supported after March.

- Suspected (but unconfirmed) local ranking update last week.

- Most SEOs are "self-taught" according to informal survey.

- Rich snippets come from on-page content, says Google.

- Google's "Bard Advanced" to be part of Google One subscription.

- Google promises to deal with increasingly spammy results.

- Perplexity.ai announces ~$74M series B investment round.

- VW to embed ChatGPT behind its voice assistant in new models.

- iStock photos betting on SMB market with gen-AI images (shouldn't use).

- Duolingo getting rid of contract translators for AI content creation.

- LinkedIn a primary beneficiary of the X advertiser exodus.

- After its first "takedown," The Verge goes after SEO again.

- Here's the "bull case" for Apple's Vision Pro headset.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.