Cooling E-Commerce, Nextdoor Trust Factor, Slammed by Rent

E-Commerce Was Hot – Now Not

E-commerce saw triple-digit growth in 2020; however growth has dramatically slowed, as stores have rebounded. A slew of new earnings reports illustrate the recent weakness. Amazon disappointed, Ebay and Etsy posted weak guidance (Ebay's total sales fell for the fourth consecutive quarter). Shopify disappointed; Wish, Wayfair, Overstock and others were also down. MasterCard reported that April in-store sales were up 10% and e-commerce was down ~2% (though up 92% vs. April 2019). Right now there's a broad sell-off among e-commerce stocks, as investors lose confidence in future growth prospects. That could change if other companies post better earnings. DoorDash and Uber were outliers, reporting 35% and 136% year-over-year revenue growth respectively. While it was always strategically dumb, investor pressure on retailers to spin out their e-commerce businesses now seems especially short-sighted.

Our take:

- E-commerce is 13% of total US retail. However consumer behavior isn't entirely reverting to pre-pandemic norms.

- Digital presence and tools increasingly drive offline sales. you can't succeed offline anymore without a successful online presence.

- Very few SMBs or enterprises will be successful if they don't fully embrace digital-first behaviors. A recent survey found, 71% of "growing SMBs" survived COVID because of digital adoption.

Nextdoor Secret Weapon: Trust

As a public company Nextdoor needs to generate user growth and revenue to satisfy investors. But the company's public-facing mission is more lofty: to build connections in the real world and "cultivate a kinder world where everyone has a neighborhood they can rely on." Accordingly, Nextdoor has been trying to change its "neighborhood watch" culture into something more positive. Nextdoor recently recently released a "constructive conversations reminder" tool to generate more civil discussions on the site. Earlier this week the company released new research that argues it's a great place to showcase your business. Survey data say 96% of users have seen business recommendations on the site, 89% value them and 72% had been influenced by them. This points to the company's secret weapon: trust.

Our take:

- Trust is in decline both online and offline. Google, Facebook, Yelp and other places are less trusted than in the past. Fake reviews don't help.

- Nextdoor could become the most trusted source for local business referrals. It could be terrifically effective for SMBs (already is for some).

- To become a primary local search tool there need to be UI/UX changes. It also should be ranking for "best [category + location]" queries.

Rents Increase, SMBs Struggle

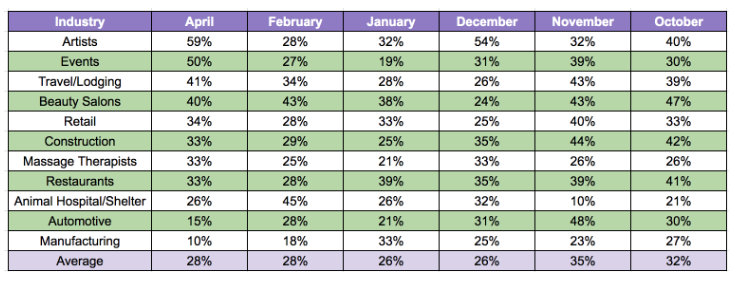

Commercial landlords continue to raise rents, putting the squeeze on many small business owners across the US. During the height of the pandemic some long-established and beloved local businesses closed because they were unable to make rent payments. According to an April survey of roughly 25K SMBs by Alignable, "46% of renters polled said their rent was higher now than it was six months ago," with another 7% saying they anticipated increases soon. Ability to pay varies by industry but overall delinquency rates have increased recently. Manufacturing had the lowest delinquency rate (10%), while live events (50%) and arts-related businesses (59%) had the highest (see below).

Our take:

- SMBs are facing labor shortages, higher costs and supply chain issues.

- In many categories consumers have continued to spend despite inflation. But that could change if inflation persists and confidence declines.

- Most SMBs survived the COVID crisis; however macroeconomic pressures now are an even greater threat in some respects.

Recent Analysis

- The Hidden Side of CX: Mining Unstructured Data, by Adam Dorfman

Short Takes

- Shopify buys Deliverr for $2.1B to boost logistics/fulfillment.

- Bogus DMCA takedown request removes Moz from Google SERP.

- Yelp turnaround: Company reports strong quarter, third in a row.

- Google buys Raxium, MicroLED display tech maker, for AR/VR.

- Apple, Google and Microsoft support passwordless sign-in standard.

- Advertiser interest in TikTok growing, declining for Facebook, Twitter.

- Co-founder of WhatsApp now regrets selling to Facebook.

- Advertisers: If Twitter relaxes content moderation we'll bail (NYT).

- Musk acquisition of Twitter faces FTC antitrust review.

- TurboTax owner Intuit agrees to pay $141M for deceiving tax filers.

- Behind search: Profile of $10 hourly search-quality rater's world.

- Google removed 3.4B ads, suspended 5.6M advertiser accounts in 2021.

- Amazon, Peacock inserting product placement digitally after the fact.

- Abortion's end could have unintended consequences for biz (WaPo).

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.