Last Click Mindset, Apple-Google AI Deal, Google #3

Google Getting Too Much Credit?

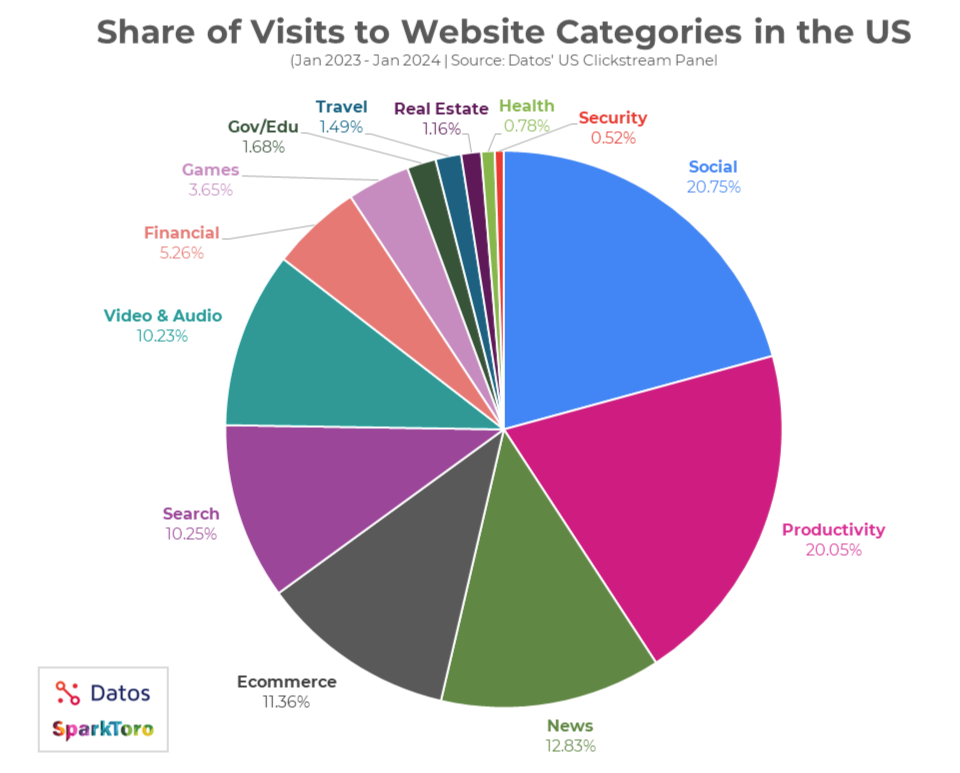

Seeking to clarify what he regards as a widespread misinterpretation of his earlier "traffic referral" study, SparkToro's Rand Fishkin published a follow up post pointing out the difference between traffic referrers and sources of "demand creation." The study originally found, "Google’s almost 10X larger than the next largest referrer in our dataset." That reinforced the perception that marketers should focus their time and resources on Google accordingly. However, Fishkin vehemently argues against this. Because "Google sends close to 2/3rds of all referral traffic to US websites ... that doesn’t mean Google is the best, only, or most important place" to focus your online marketing efforts. If you look at share of visits (uniques), time and engagement, Fishkin contends, a different picture emerges. Search is fourth and fifth in these categories respectively, with social media in the top position. He asserts that a substantial amount of Google traffic is navigational or sits between discovery and conversions. He's describing a kind of "last click" attribution problem: Google gets more credit than it should.

Our take:

- Fishkin: a "search exclusive" or mostly search marketing strategy is a mistake. Local is potentially more debatable; but see below.

- Another argument: zero-click (Snippets, Local, etc.), SGE and other Google efforts combat low engagement/time on site for search.

- It's absolutely true that marketers should build brand awareness and stimulate demand outside of search (e.g., on social).

Apple's Pending Gemini Deal

Apple is reportedly talking to Google and OpenAI about incorporating their AI technology into iOS 18. Google appears to be the more likely partner for Apple, given their long-standing default search deal. (As an aside, that deal will likely be found to have broken US antitrust laws in the next few months.) Over the past year Apple has been pouring enormous resources into AI development and is apparently on track to announce AI features at its developer conference this June. Gemini may be a core component of those capabilities. It's also possible that Apple will deliver an AI cocktail, with some features provided by its own technology and others via third parties or Google exclusively. Many commentators saw the report as analogous to the default search relationship. Yet web search is "external" to the core iPhone user experience. AI would potentially be more integrated or central to iOS 18. Of course we'll have to see what gets announced. But if the Gemini deal does happen, it could put Google's AI technology on roughly 2 billion iPhones globally. That would be a coup vs. rival OpenAI. It could also raise additional antitrust concerns.

Our take:

- The negotiation is an admission by Apple that its AI technology and capabilities are lagging and/or inferior.

- It's somewhat surprising that Apple isn't using open-source tools or working with a smaller AI company that it could eventually buy.

- AI is strategic going forward and Apple shouldn't be dependent on a rival for a core device capability, though perhaps this is a stop-gap measure.

For Gen Z Google Is #3

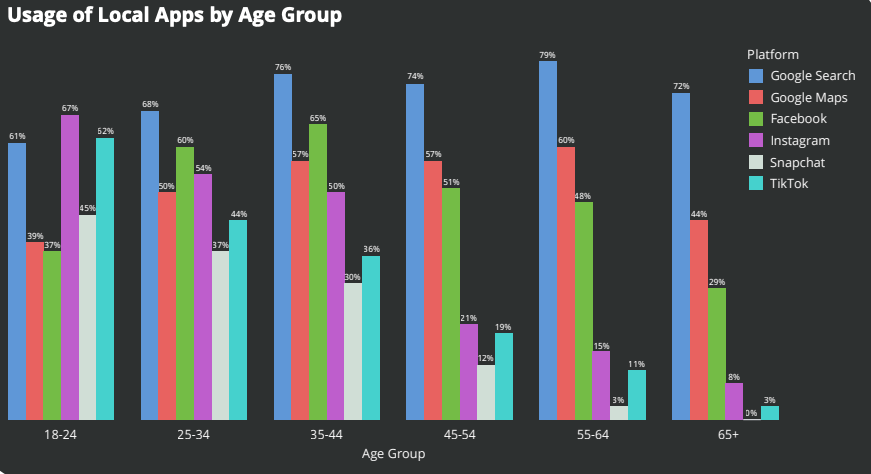

At a conference in July 2022 Google SVP Prabhakar Raghavan said, "In our studies, something like almost 40% of young people, when they’re looking for a place for lunch, they don’t go to Google Maps or Search ... They go to TikTok or Instagram." This was something of a surprise but also strategic PR to help Google's antitrust position. Since then, third party studies have confirmed that Gen Z has diversified its search behavior beyond Google (e.g., Adobe, Tinuiti). New research from SOCi looks at this same question through a local lens. In a survey of 1,000 consumers the company asked, "Which smartphone apps or websites have you used in the last 30 days to look up information about local businesses?" Google Search was dominant (72%), followed by Google Maps (51%), Facebook (49%), Instagram (33%), TikTok (27%) and others. Apple Maps and Yelp were tied for seventh place at 16% apiece. (The responses indicate people are using multiple sites for local search.) However, when the data are segmented by age (18 - 24), it looks like this: Instagram (67%), Tiktok (62%) and Google Search (61%). SOCi added, "[A]ccording to our findings, Gen Z is even more likely to use social apps for local search and discovery than they were 18 months ago."

Our take:

- Google leads for all age groups 25 and above. This is especially true for those over 45 years old.

- The study presents a more "competitive" picture of local search than the dominant narrative and marketer perceptions.

- This data validates Rand Fishkin's argument above that (local) marketers should focus on more than just Google.

Recent Analysis

- Near Media podcast episode 150 with Cyrus Shepard: on-page factors + Google updates, lessons from a Quality Rater, and what is the future of SEO?

Short Takes

- New head of Google search Elizabeth Reid started in Local.

- Suspended Google Business Profiles can get a second review.

- How important is Schema for Local SEO?

- Google's "Perspectives" filter to become "Forums."

- Some EU users unhappy about Google Maps' DMA changes.

- How to rank for Google's Hidden Gems social content slots.

- Core Web Vitals a ranking signal but not a "ranking system."

- Google: HCU classifier is gone, now part of core update system.

- Related Posts and internal linking can boost rankings somewhat.

- Apple Vision Pro is "amazing" but not ready for the masses.

- TikTok paying creators to generate more search-worthy content.

- Content creators need to go the extra mile to stand out in SERPs.

- Google's VLOGGER needs just one image to create full motion video.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.