Fast Cheap Content, Threads Cools Down, Prime Day Record

Fast, Cheap Content

For months we've been debating the impact of generative AI on search. Some marketers argue AI will "revolutionize the SERPs." That's true – it's already in process on the back end – but maybe not in the way people assume. The press has focused largely on the "disruption of Google" narrative. But there's evidence that ChatGPT's usage is mostly for B2B purposes and the novelty of BingGPT is wearing off. So Google's market share appears safe for now. Yet marketers' adoption of AI continues to accelerate. One SEO on LinkedIn says he's created "a fully automated (end-to-end) content generator engine that can publish up to 200 articles per day, fully autonomously ..." This is the future: more and more content generated by machine with limited human intervention. And whether you believe AI tools will strengthen or weaken content, it's clear AI content will be everywhere. Most marketers will want fast, cheap content unless Google's HCU successfully detects it and demotes it. I fear the best case isn't good and the worst case is much worse.

Our take:

- Google is agnostic about AI content, as long "as it's written for people" and not to rank. But that ignores the reality and incentives of SEO.

- As marketers embrace "efficient" but likely mediocre AI content, many consumers may flee the SERP for more "authentic content" (e.g., TikTok).

- Google killed content farms more than a decade ago, as a threat to the long-term health of the SERP. This is a much bigger challenge.

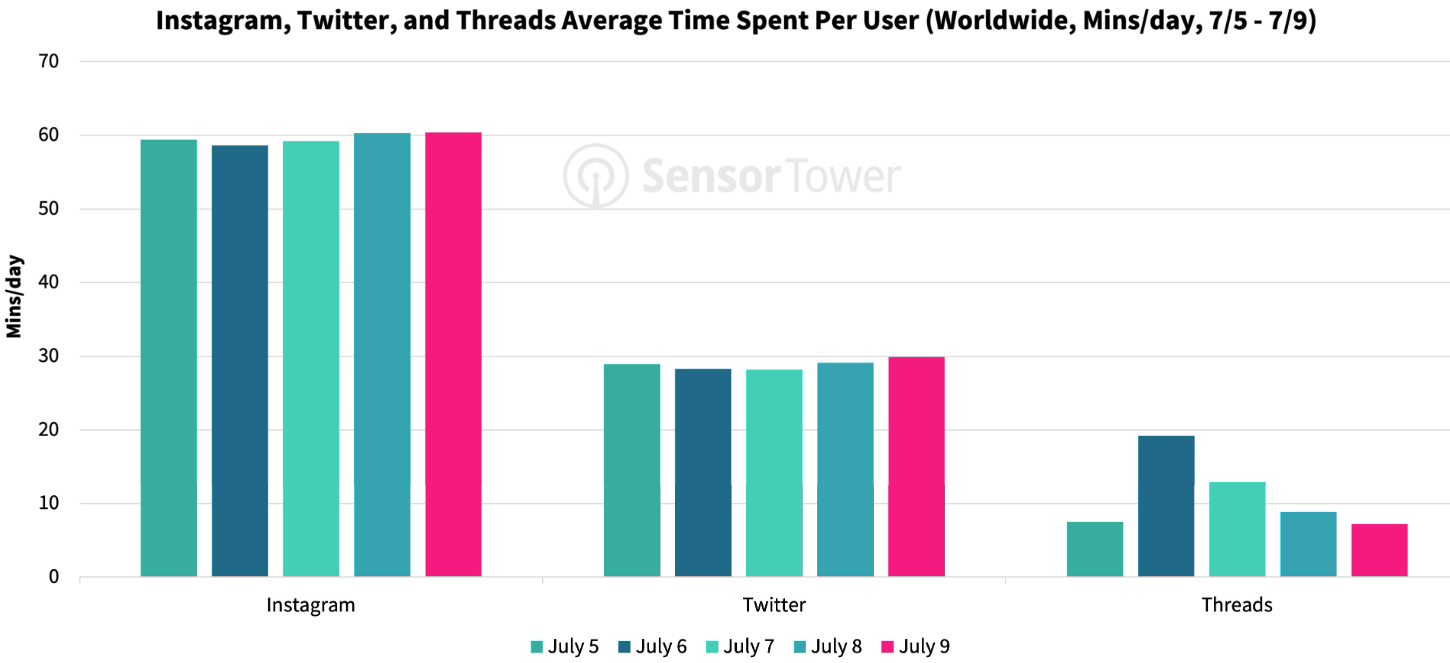

Threads Slips, Twitter Bleeds

Last week we discussed how Twitter's missteps opened the door for Threads, which capitalized on demand for a Twitter clone with scale. Threads became the fastest app to 100 million users (in 5 days), beating ChatGPT's two month record. Twitter seemed to suffer a parallel usage decline. However, data late last week from Similarweb and Sensor Tower show Threads' growth has apparently slowed and engagement has declined (although there are positive signs for brands). There was a drop in time spent of more than 50% (20 minutes to ~8 minutes) and a roughly 25% decline in daily active users. The novelty of Threads may be wearing off. Meanwhile, a diminished Twitter appears to be bleeding cash because of a 50% drop in ad revenue that paid verification hasn't been able to compensate for. It's tempting to write Twitter's epitaph but way too soon. Threads and Twitter will now go head-to-head. The other clones will mostly be on the sidelines.

Our take:

- Twitter will need to take some dramatic steps to lure advertisers back. Twitter Blue has probably already maxed out its potential base.

- Twitter Blue subscribers are estimated to be ~290K to ~400K. Assuming 300K, Twitter is generating about $28 million annually.

- Threads needs to add features and a desktop version. Right now, the app is like being at a loud party with a lot of people you don't know.

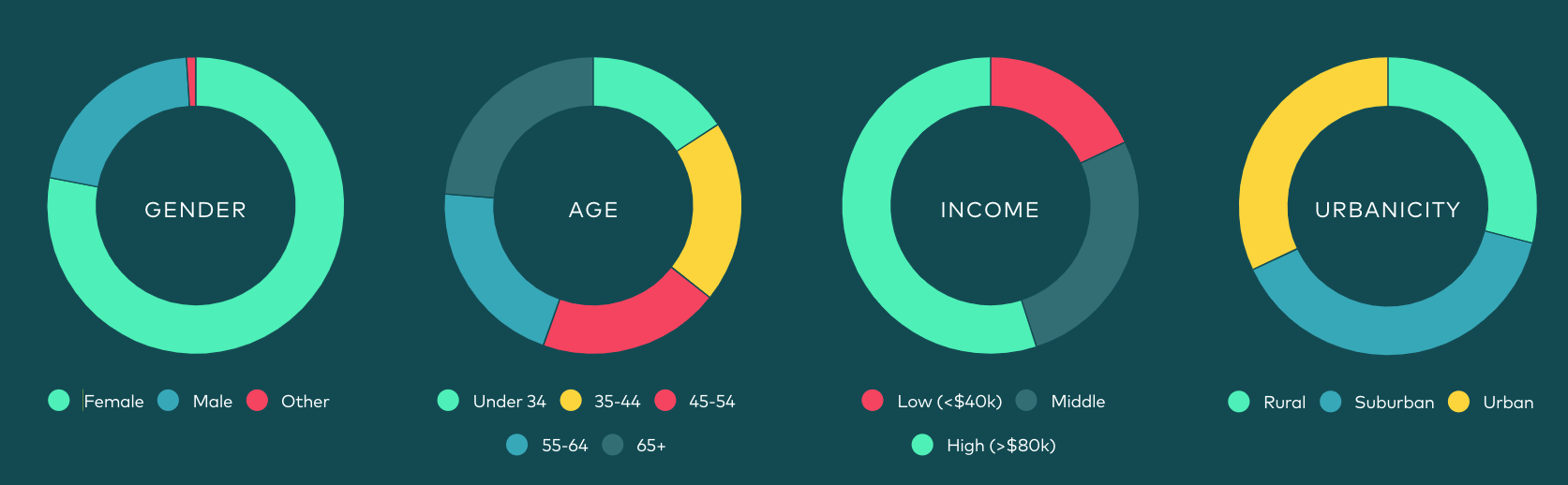

Prime Day by the Numbers

By all accounts, Prime Day was a major success. July 11 was the largest sales day in company history according to Amazon. Total spending over the two day sale was just shy of $13 billion ($12.7 billion) in the US, said Adobe, representing 6.1% growth YoY. That was up from $11.9 billion last year. Still, Adobe had predicted 9.5% growth. Success was attributed to "steep discounting" and many consumers delaying purchases until Prime Day. Adobe reported that buy-now-pay-later (BNPL) was used by 6.5% of shoppers, generating $927 million in sales. But the striking thing is that BNPL was up 20% YoY. Adobe also said that curbside pickup was used for 20% of online orders (when offered). That basically held steady vs. last year. Smartphones were responsible for roughly 47% of orders, up from 44% last year. According to Numerator, the average household spend was $156. The typical Prime Day shopper "was a high income, suburban female age 35 to 44," and a Prime subscriber since at least 2019.

Our take:

- There's good news here for the economy. While there was significant discounting, robust spending reflects positive consumer sentiment.

- I was apparently wrong that consumers were blase about Prime Day. But while strong, it still underperformed expectations.

- Roughly 75% of Prime subscribers are in the US, where growth has stalled. So international expansion is the way forward for Amazon.

Recent Analysis

- Near Memo episode 120: Apple Maps KPIs; what Google quality rater guidelines can teach SEOs; Google SGE usage decline.

Short Takes

- Wix about to launch a full-on AI site generator.

- Scammer replaces Delta customer service number on Google.

- Bard gets new features, languages, expands to more countries.

- Google's NotebookLM is a first attempt at a personal AI.

- Everything you wanted to know about Google quality raters.

- Albertsons partners with Meta on dynamic local circulars.

- DoorDash, rivals sue to block wage increase for drivers in NYC.

- Furniture retailer uses shopping cart bot to negotiate with buyers.

- Brand visibility on TikTok at lower cost vs. search engines.

- Salesforce and MSFT Dynamics the top CRMs for SMBs.

- Evidence of a digital ad spending rebound in May.

- Actors' strike partly about usage of their AI likenesses.

- EU workers fear being replaced or having wages reduced by AI.

- Oppenheimer film's not-so-subtext is about AI.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.