Internal Links Drive Clicks, Google Support Decline, Social vs. Search Growth

Study: Internal Links Drive Clicks

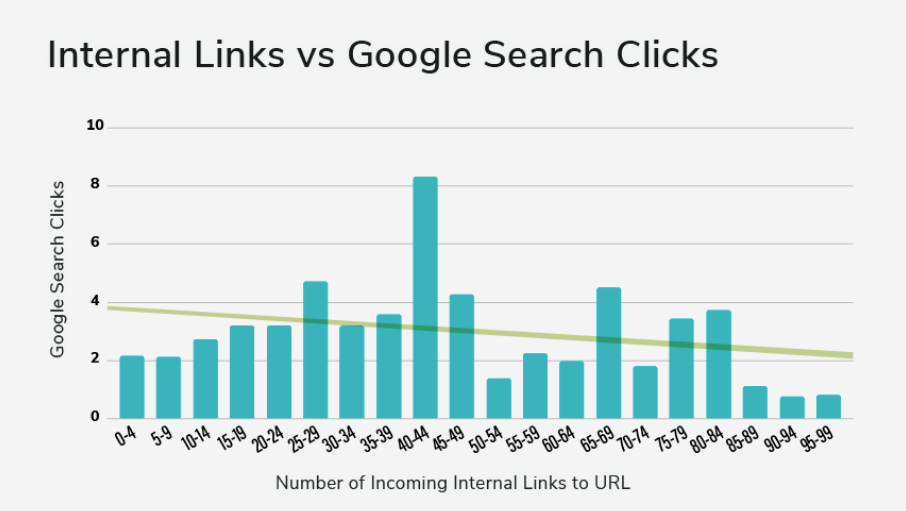

Internal linking is a much-neglected ranking opportunity. A new study from Zyppy SEO shows us the data. Based an analysis of "23 million internal links across 1,800 websites, representing approximately 520,000 individual URLs," the study found that more internal links boost traffic and user clicks. Zyppy SEO determined that "URLs with 0-4 internal links only saw two clicks on average from Google Search, while URLs with 40-44 internal links saw four times that many." After 44, there appear to be diminishing or at least uncertain returns (see graphic below); more links didn't always equal increased clicks. The study also looked extensively at anchor text and found that anchor text variety strongly impacted traffic and clicks. For example, "exact match anchors are [often] associated with significantly higher traffic." Zyppy qualified its findings by saying the link sample was modest (relatively speaking) and that it's a correlation study, which implies causation but doesn't guarantee it.

Our take:

- Most of Zyppy's discussion is dedicated to the nuances of anchor text. There's related analysis of sitewide/navigation links and their impact.

- In Near Media consulting we've seen that internal linking is often neglected. It can deliver "quick wins" for clients in many instances.

- Finding and implementing the "Goldilocks" number of internal links is going to be challenging. Generally more is better – to a point.

Will AI Further Erode Google Support?

A new global survey from PwC, of more than 4,000 CEOs in over 100 countries, argues that forthcoming generative AI implementations will result in staffing reductions of "at least 5%" in 2024. Google is a case in point. AI-driven restructuring in the company's Google Assistant unit and in ad sales (30,000 headcount) has resulted or will result in thousands of job losses as more automation takes hold. While that may work reasonably well in some situations, in others it could be disaster. For example, Google ad support "is at an all-time low" according to some agencies and will likely only get worse as humans are replaced by AI. Google Business Profile support has long been weak or barely there (except for Product Experts). There have been isolated improvements (e.g., Google reinstatement process), mostly driven by new EU regulations. Indeed, EU rules may be something of a backstop against radical support cuts. Google faces pressure to generate more revenue and profit to satisfy investors, as growth slows and competitive threats increase. Layoffs are a part of that equation to keep capital markets happy. Google is not alone, AI and reorgs will be part of every major company's strategy to reduce costs going forward.

Our take:

- There's a lot of hope and hype surrounding AI-enhanced customer service. I'll believe it when I see it.

- Many companies believe that technology can largely replace people. But you need conscientious humans in the mix to deliver competent, reliable service.

- Expect continued erosion of Google support as financial considerations dictate further elimination of support and service-related roles.

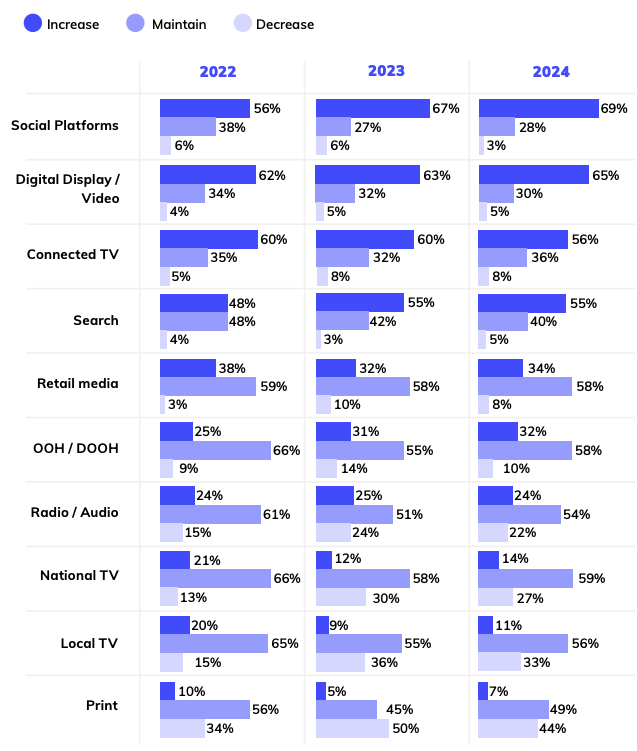

Search Lags Social in Spending

Practically every week there's a new survey about generative AI. According to the recently published 2024 Advertising Outlook Report from Mediaocean, the top generative AI use cases for marketers, brands and agencies are: 1) Data analysis, 2) Market research, 3) Copywriting, 4) Image generation, 5) Customer service, 6) SEO. By comparison, Copywriting was the number one use case a year ago. While most of the 1,000 survey respondents are optimistic about the outlook for 2024, they're also quite anxious about the end of cookies and reduced measurement capabilities. In terms of expected marketing and ad spending plans, the growth areas are: 1) Social, 2) Display/Video, 3) CTV and 4) Search (which presumably includes PPC and SEO). Traditional media channels are poised for further decline. While social media can certainly be a direct response channel, the spending increases appear to be highly brand/branding related. However, brand advertising came in third after "performance-drive [sic] paid media" and "measurement & attribution capabilities" on the list of critical marketing investments. "First-party data mastery" was a lower priority, which is strange given the anxiety around cookie deprecation.

Our take:

- The report doesn't identify the roles of respondents. Thus we don't know if they're decision makers. Presumably yes.

- Search is poised for meaningful growth, though not as much as other digital channels. But intentions and behavior are different.

- The emphasis on brand advertising is largely correct because of the strategic importance of brand, especially now in search.

Recent Analysis

- Near Memo podcast episode 141: Google Guarantee LSA scam impact; did Google 'enshitify' the internet?; gen-AI and its potential impact on Google.

- Google Guarantee-LSA Scam in Home Services: A Marketer's Insight – interview by Mike Blumenthal.

Short Takes

- About to be shut down, GBP sites still rank for more than 8M queries.

- Explainer: understanding GBP performance insights.

- Google Maps will soon be able to navigate inside tunnels (with caveats).

- Author bylines/bios don't help with ranking on Google.

- Why Google's ad algorithms can be inefficient.

- AI may help solve cookie deprecation.

- Google appears to reward AI-generated articles, despite low quality.

- EU forcing Google to let users "unlink" its services (i.e., data sharing).

- Apple iPhone takes global smartphone share lead for the first time.

- Apple now required to let developers point users to web for payments.

- Google planning major Android Auto expansion.

- Microsoft introduces Copilot Pro for $20 per month per user.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.