Is Google's DMA Compliance DOA for Local Searches in Europe?

Places Sites may as well not exist. The module drives almost no engagement, even above the fold.

SUMMARY

The new Places Sites module, introduced to comply with European Union regulations around self-preferencing, may as well be invisible.

- Near Media's proprietary research found that 40% of restaurant searchers in Ireland don't scroll down far enough in a typical search result to even encounter the Places Sites module.

- For the 60% of searchers who do see Places Sites, there's almost no engagement and even fewer clicks to the directories that are supposed to benefit from it.

- Google's own Local Pack results still capture the majority of engagements and clicks from all searchers – and the vast majority clicks from mobile searchers.

HOW WE CONDUCTED THE STUDY

We presented 100* Irish consumers with the following scenario:

It's a Friday evening and you'd like to go out for a nice dinner with a couple of friends to celebrate a long but successful workweek.

You want to try a new place you haven't been to before, and you go to Google to help you find what you're looking for.

We loaded the default Google.ie homepage in their browsers. We then recorded their screens and audio narration (with permission), and aggregated and analyzed their behavior and decision-making rationales.

Among the questions we sought to answer:

- What search result types received the most engagement, and by extension, did the new Places Sites module experience meaningful engagement?

- Which directories, if any, received the biggest boost from this new (ostensibly more favorable) post-DMA treatment?

- How widespread is the "zero-click search" phenomenon, whereby a searcher never leaves Google's own properties before making a decision?

In line with our client-focused research, we also sought to answer:

- What digital presence(s) should the typical Irish restaurant prioritize?

- What restaurant attributes are most compelling to consumers?

- How many restaurants does a typical consumer consider prior to making a choice resulting in a visit/or reservation?

*100 searchers is a small sample size, but still large enough to illustrate trends. We're eager to pursue a continuation of this study with a larger sample as our budget permits.

RESULTS

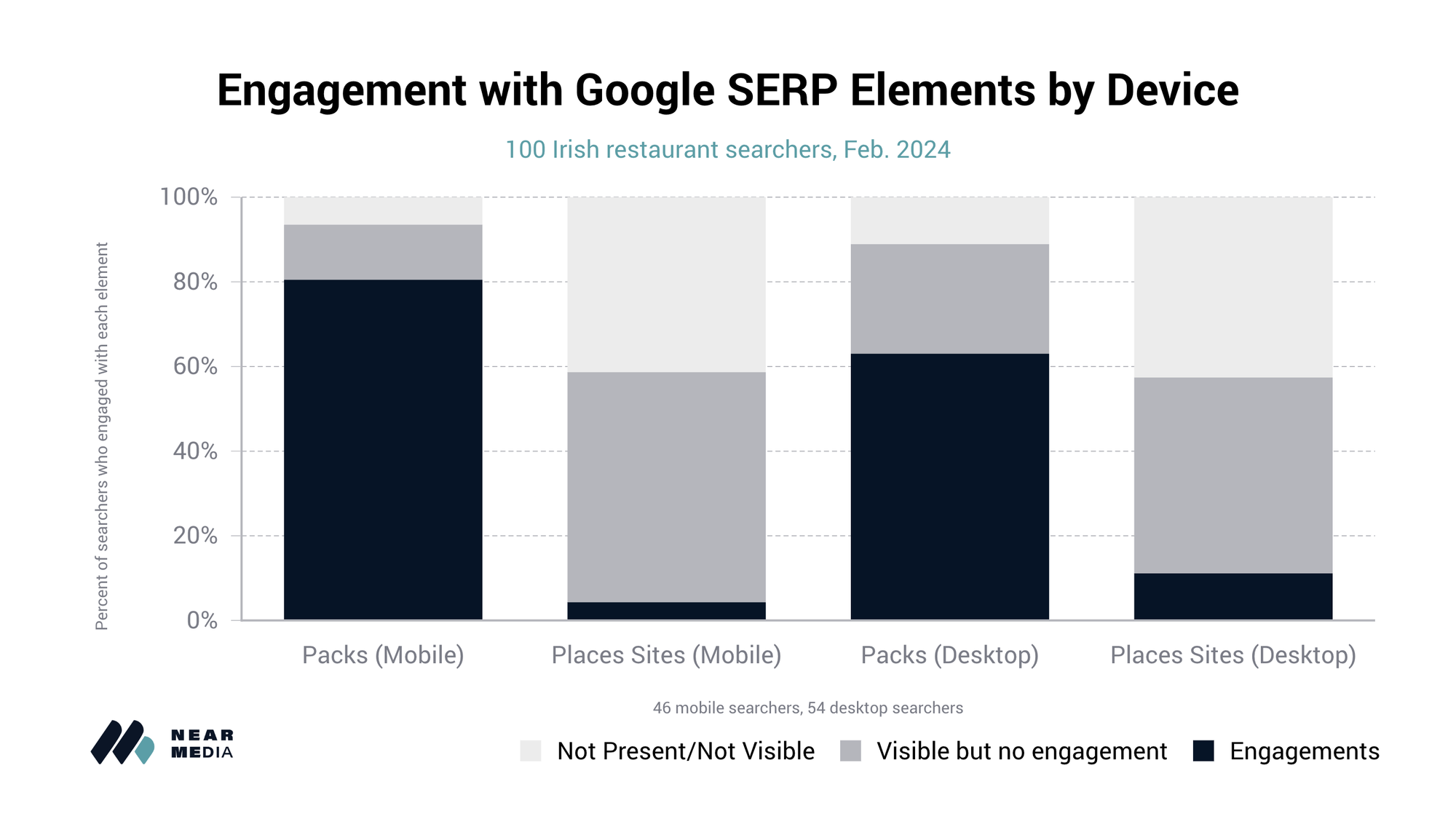

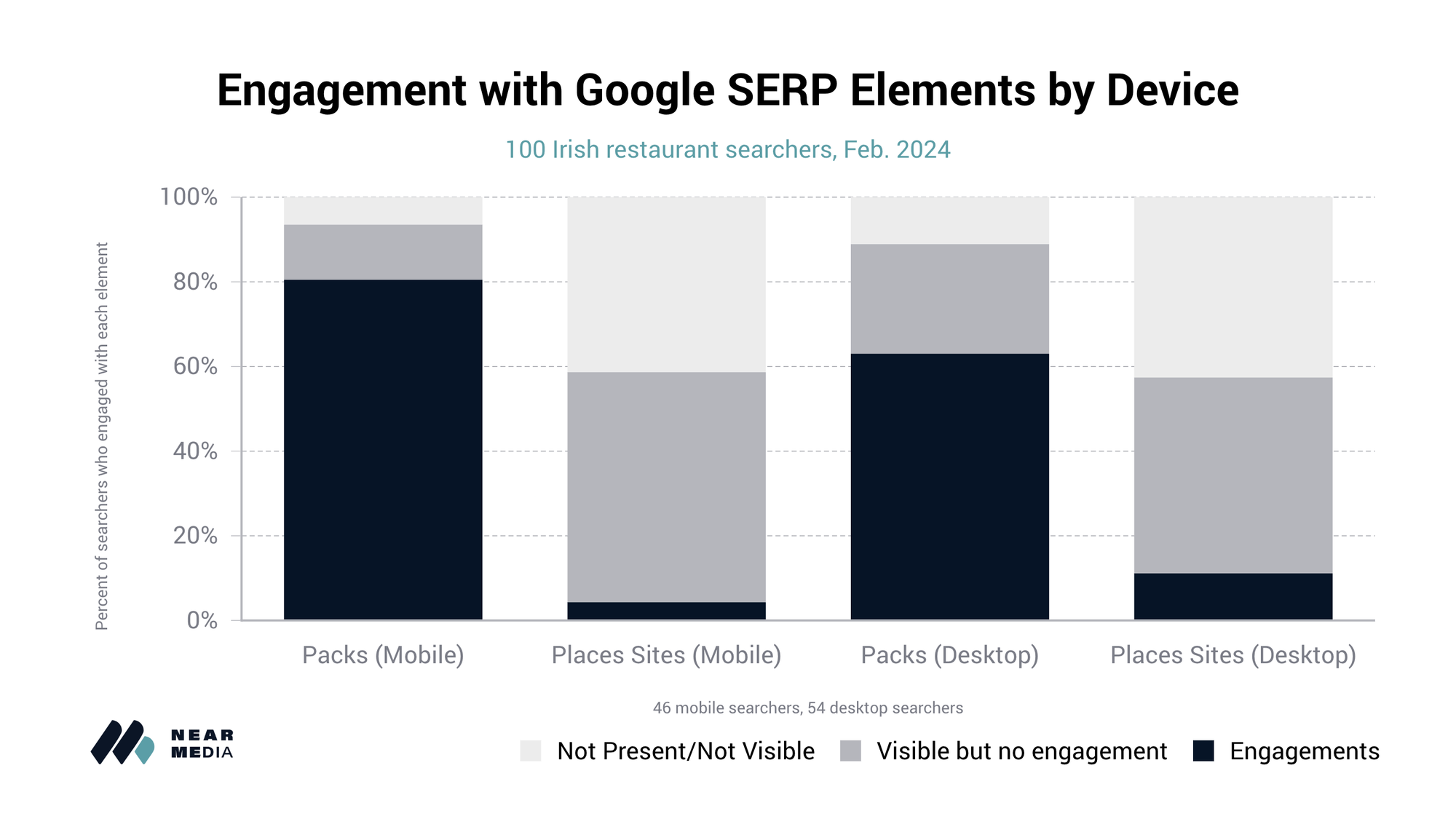

Engagement with SERP Elements

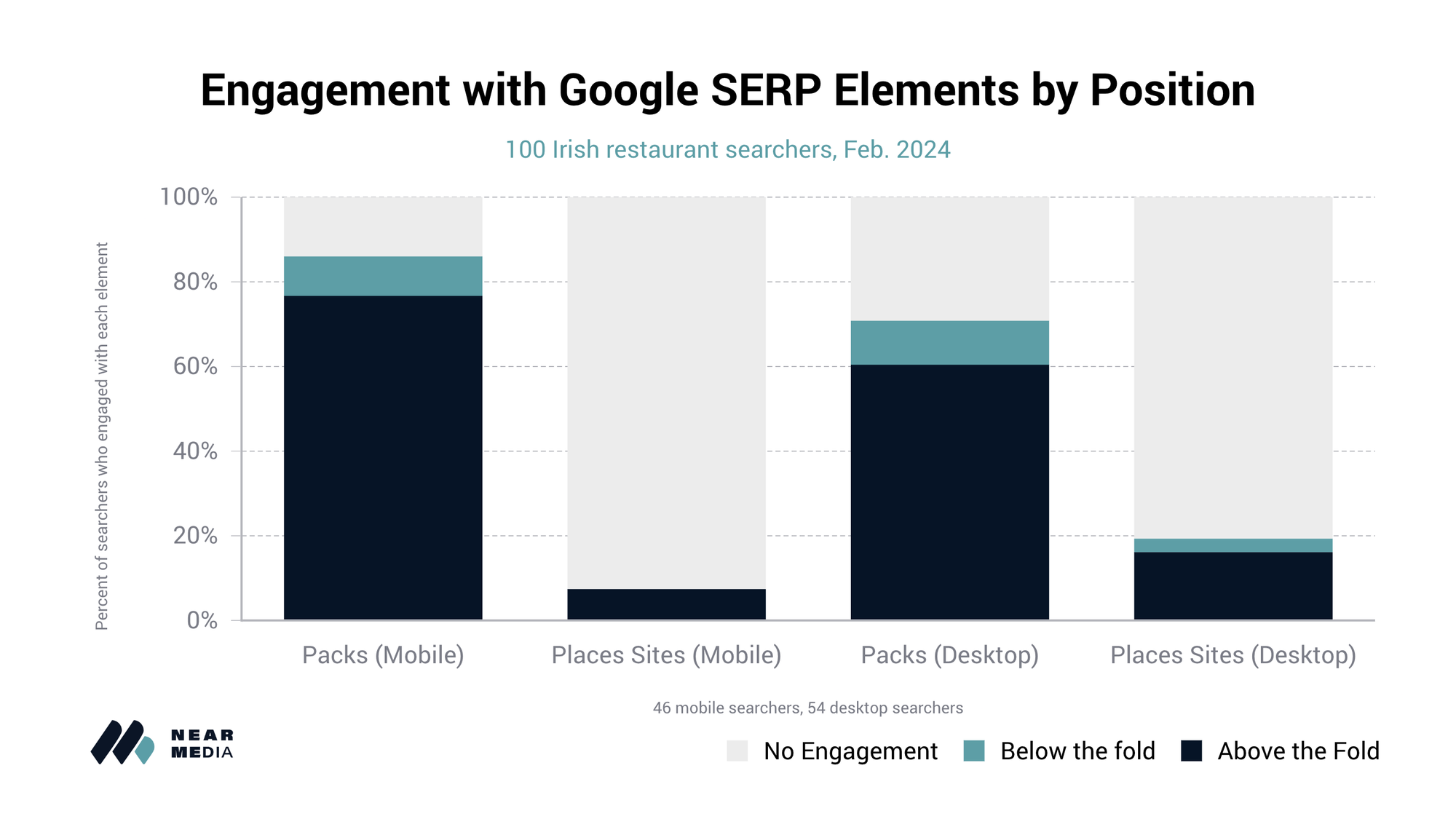

We found that 40% of Irish restaurant searchers don't scroll far enough to even encounter the Places Sites module, in a typical search result. For the 60% searchers who do see it on the page, there is almost no engagement, and even fewer clicks to the directories that are supposed to benefit from it.

This is true regardless of where the Places Sites module appears, above the fold in the searcher's initial SERP view or below it, where they have to scroll to see it.

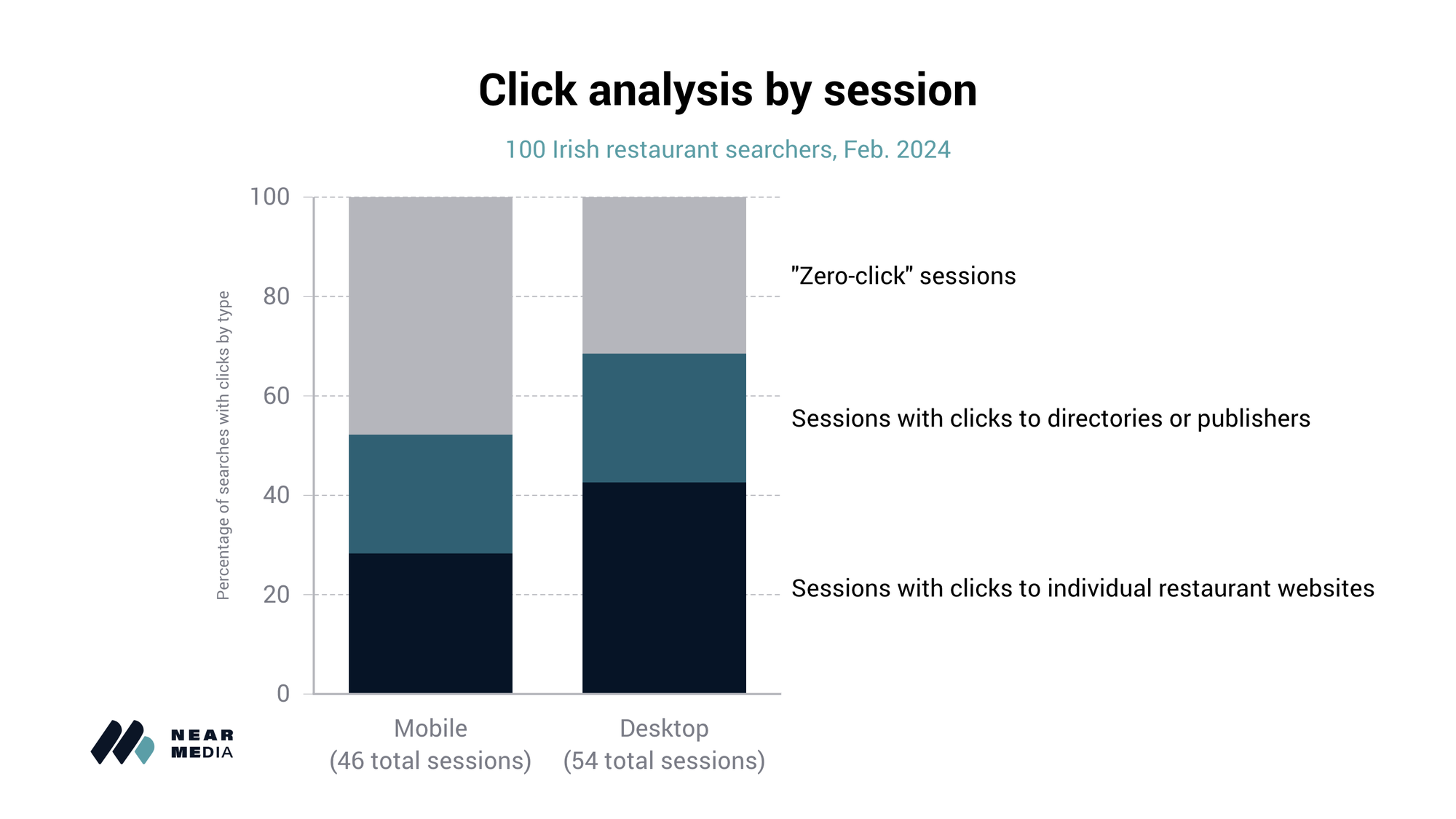

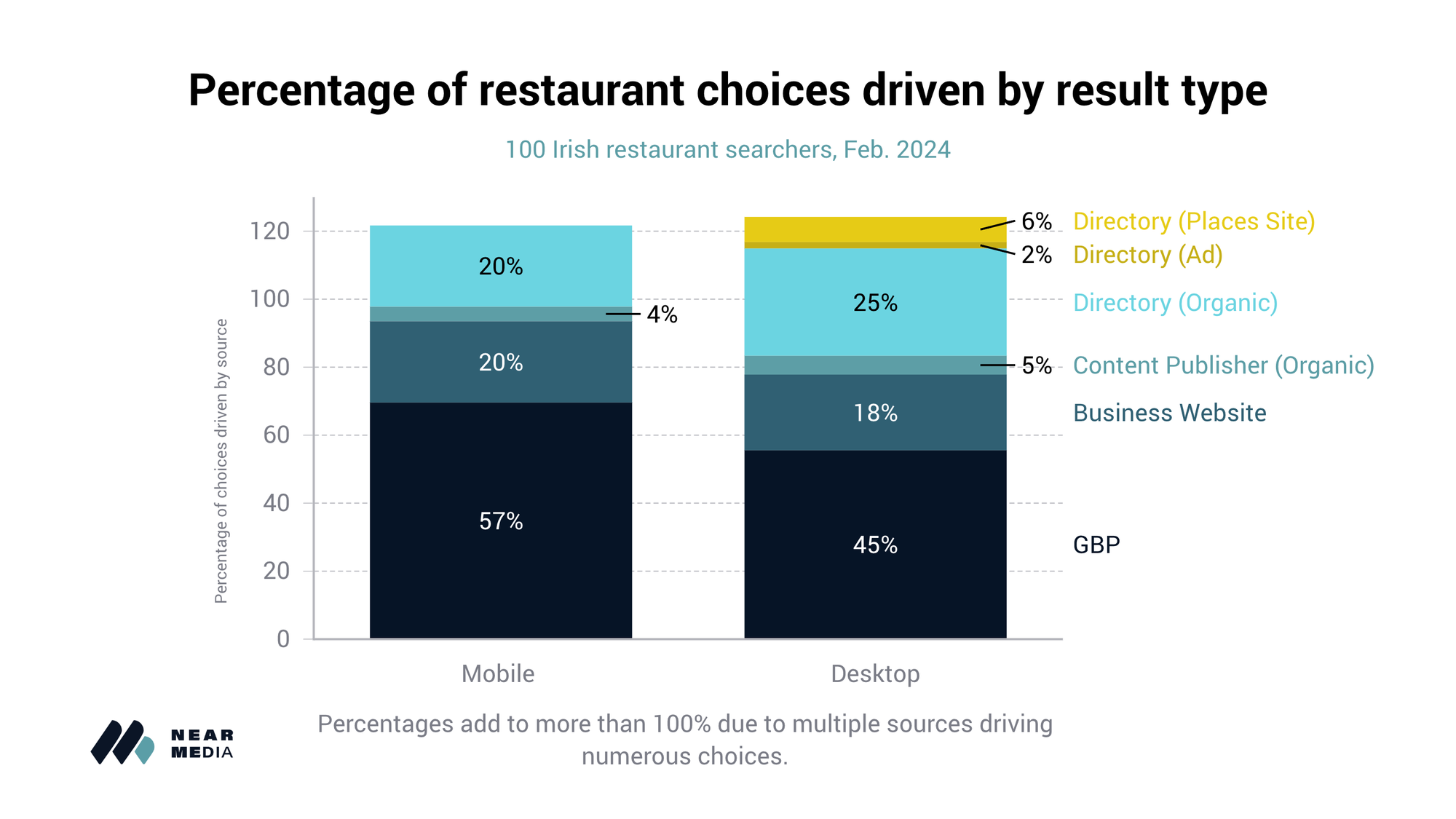

Google's own Local Pack results still drive the majority of engagements and clicks from all searchers. But they generate the overwhelming majority of clicks from mobile searchers.

Directory Engagement

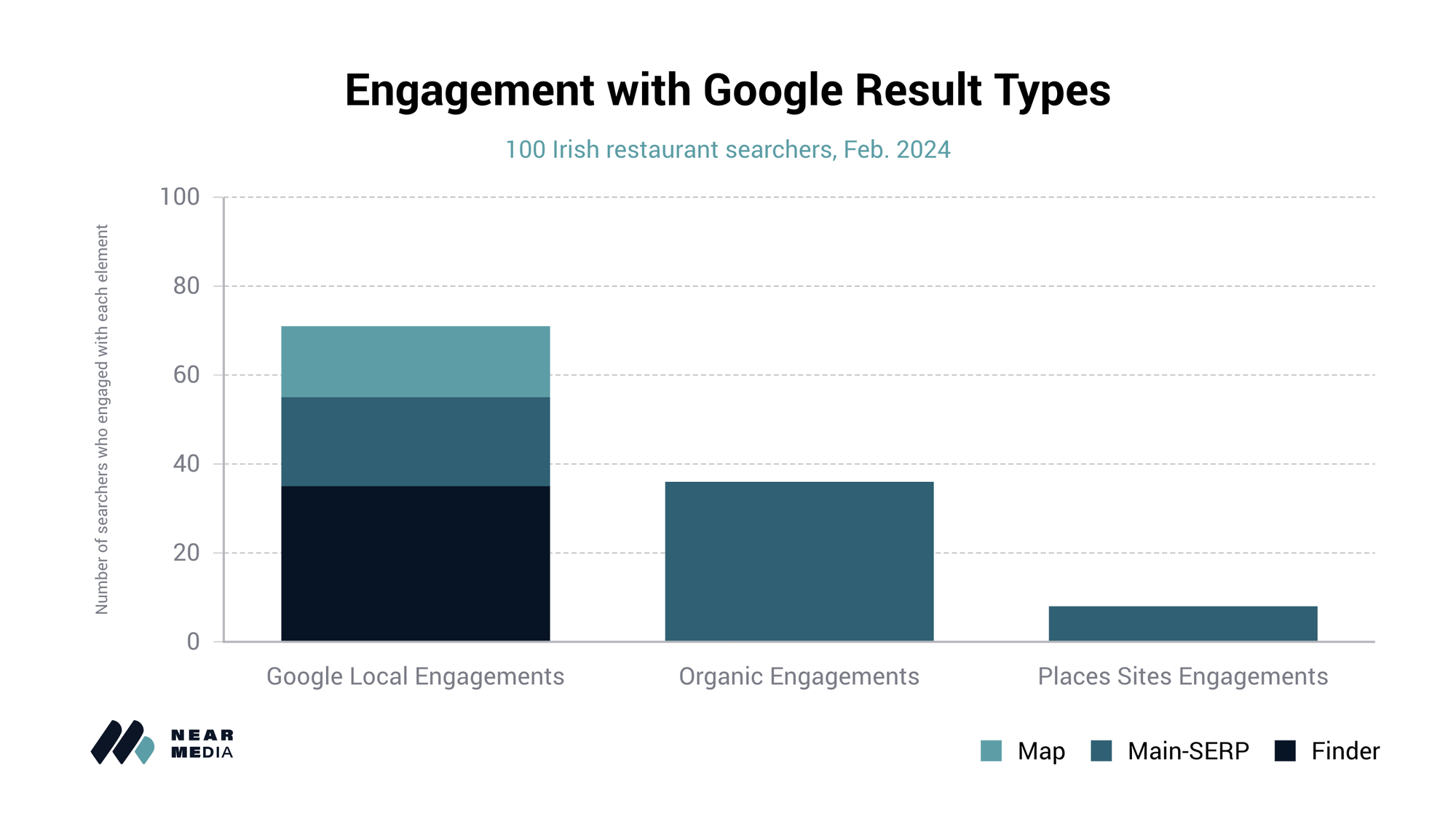

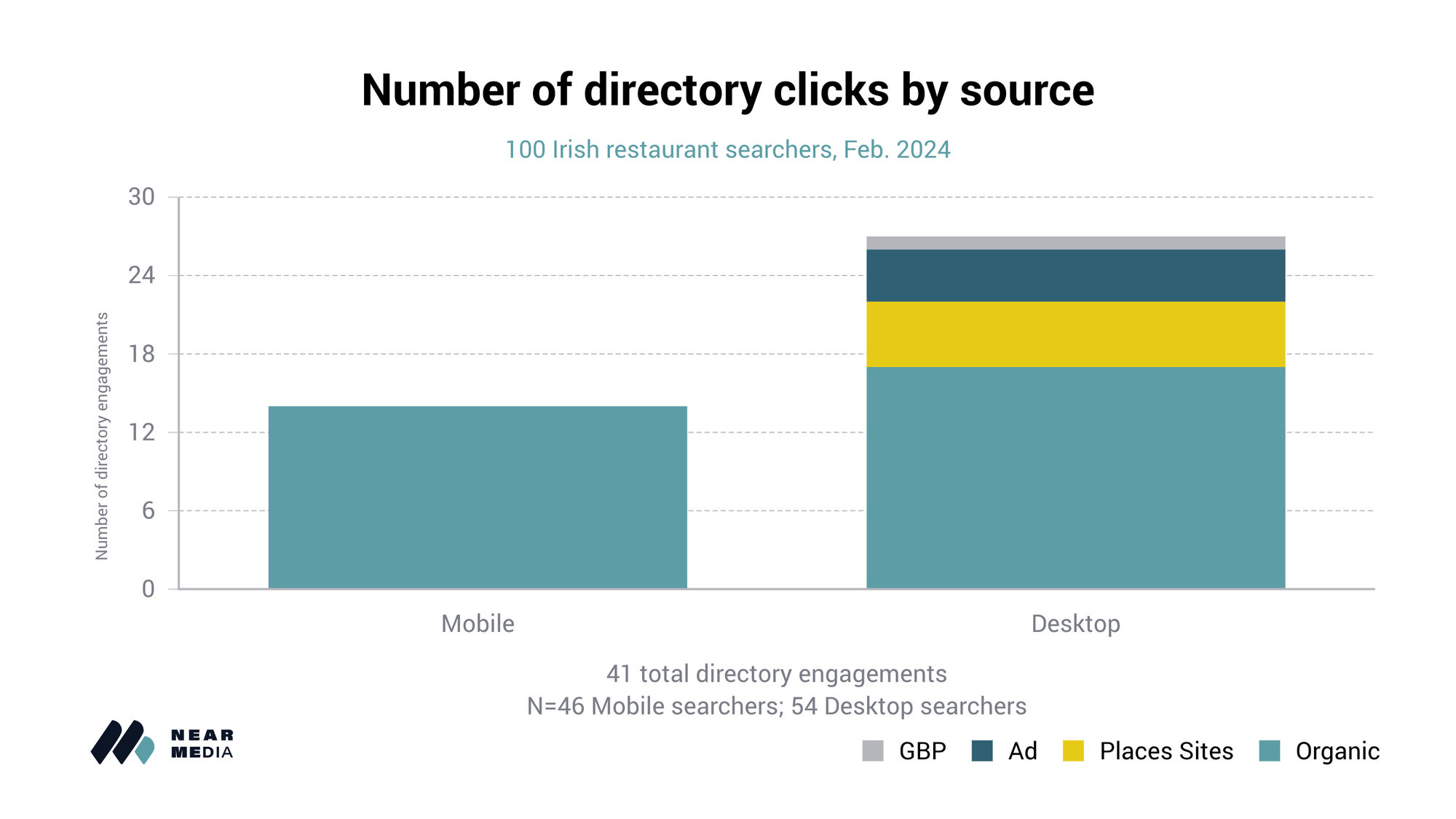

N.B., the term "engagements" is charitable towards the Places Sites module – 3 out of 8 engagements were horizontal scrolls that did not result in a click to any Places Site.

Organic results drove roughly 6x the number of clicks for directories as the Places Sites module. Yet even organic directory clicks paled in comparison to the volume of clicks on Google's own properties: the Local Pack and Local Finder.

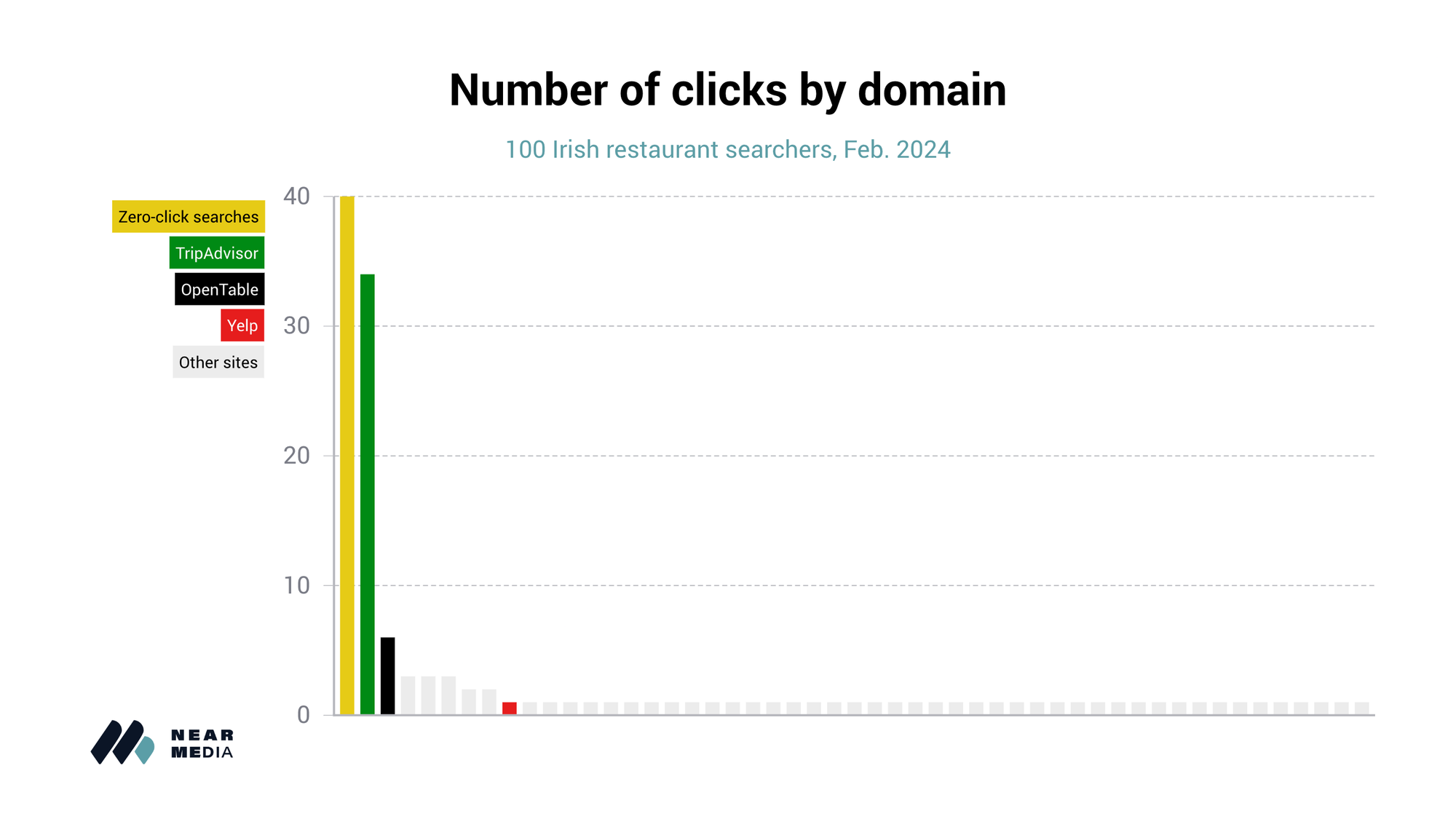

TripAdvisor has an incredibly strong brand among Irish consumers, earning nearly as many clicks as Google's own properties. As noted, these came overwhelmingly from organic search, where TripAdvisor frequently occupied the top result.

Despite being arguably the loudest and most persistent anti-Google gadfly, Yelp has almost no presence in Ireland.

'Zero-click Search'

We found that "zero-click search" is a very real phenomenon in the restaurant category. Half of all mobile searchers and about a third of desktop searchers never left Google.ie prior to choosing a restaurant.

Where Should Irish Restaurateurs Invest Digitally?

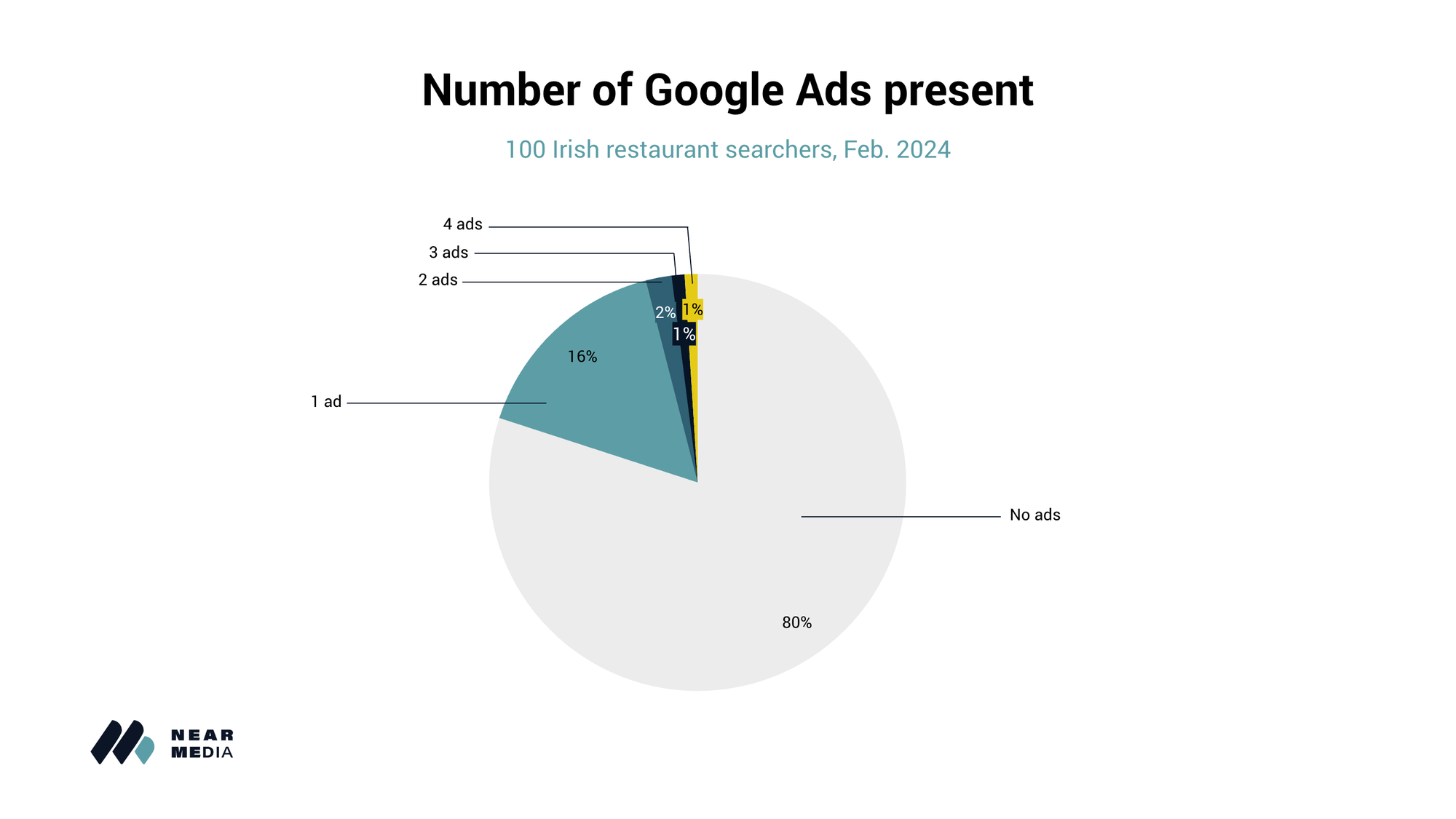

Not Ads.

Restaurants are a surprisingly under-monetized category for Google – perhaps cost-per-conversion simply does not pencil out for razor-thin restaurant margins. Not only were there comparatively few ads, we saw few clicks on Ads as well.

Irish restaurateurs and restaurant marketers would be better-served focusing on their TripAdvisor presence and write-ups from critics, than paying Google for sponsored visibility – a much different conclusion than we drew for our clients in the U.S. legal and self-storage verticals.

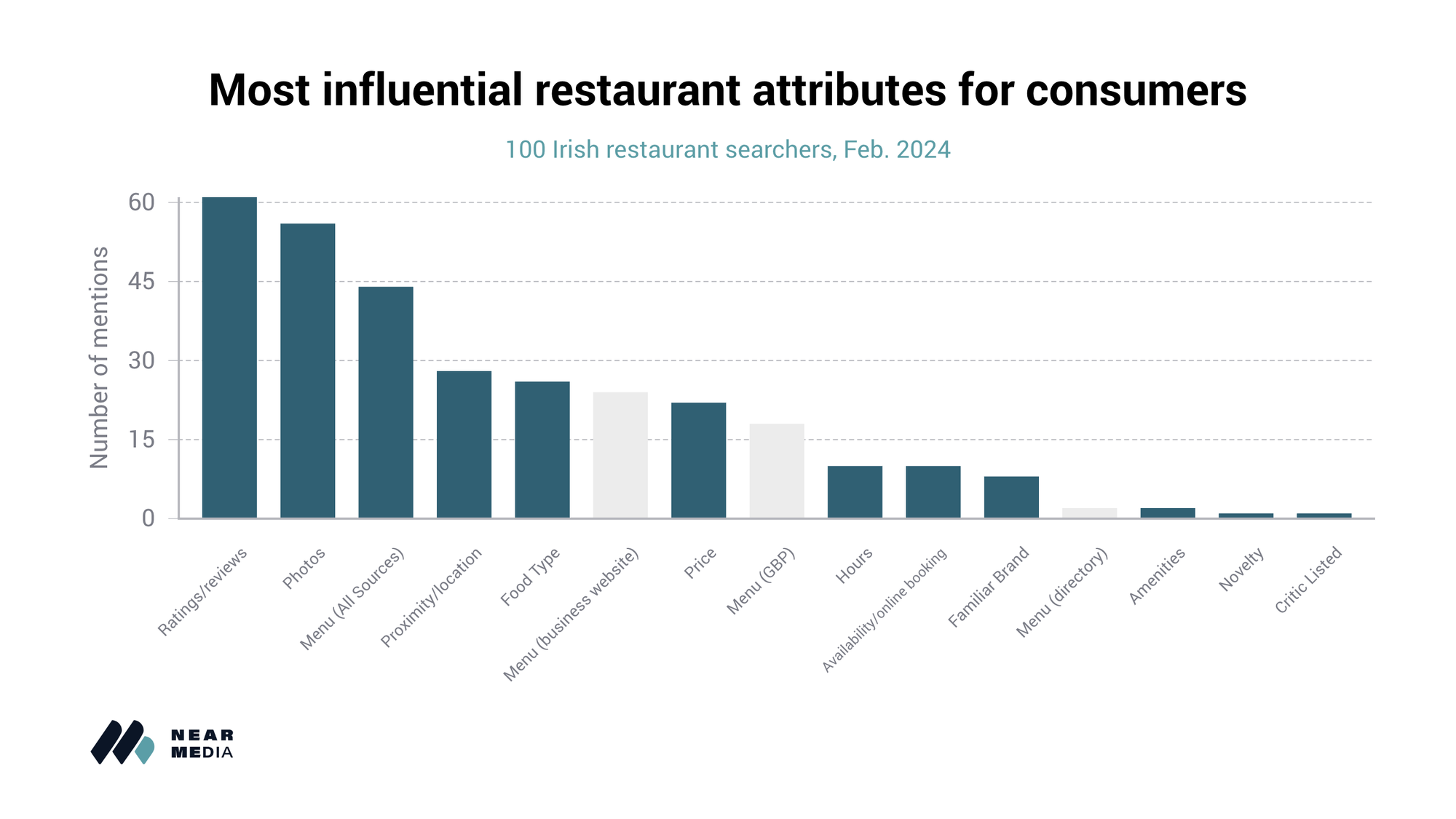

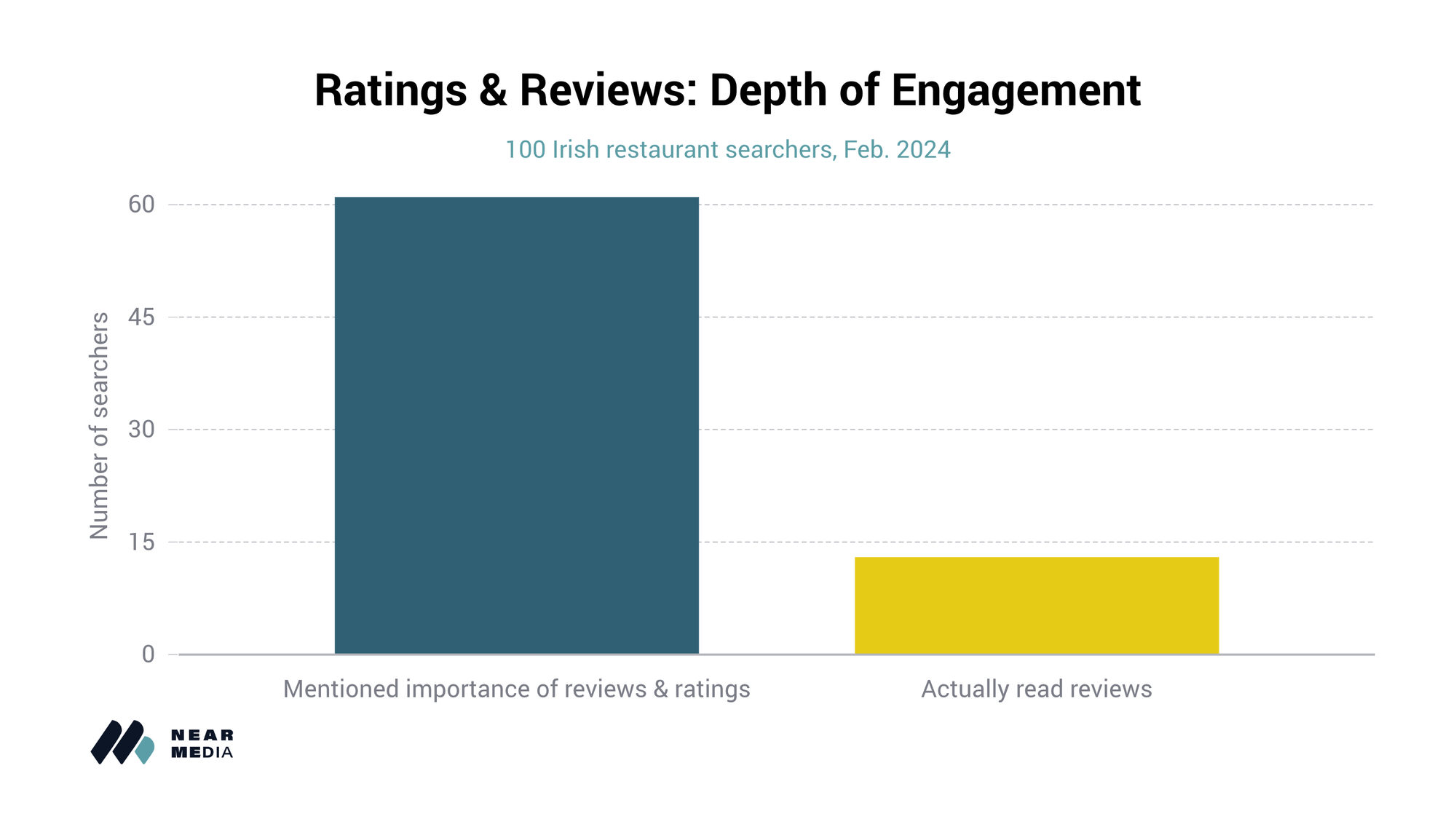

Ratings and reviews are, unsurprisingly, the most influential factor in consumers' evaluation of restaurants, explicitly mentioned by over 60% of searchers.

More surprisingly, only 21% of the searchers who mentioned reviews and ratings being important actually read the text of any reviews prior to making a restaurant selection.

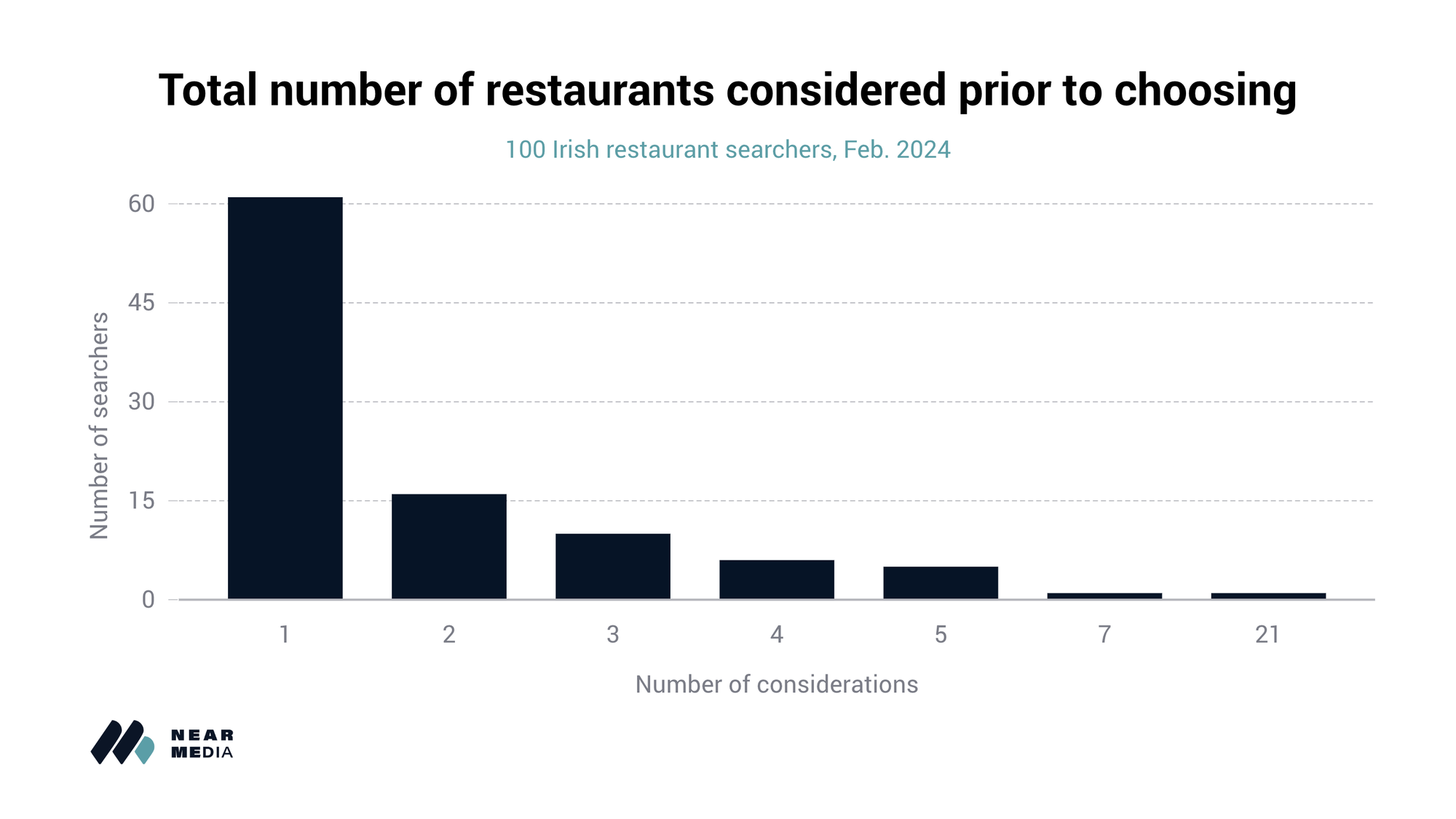

Searchers don't spend a long time evaluating restaurants. That means the first impression has to be a great one. That argues for great reviews, great photos, readily-available menus, and online booking to convert prospective diners.

This is particularly true on GBP, which drove the majority of all restaurant choices, though restaurant sites were seen as a reliable source for menus and reservation availability.

Takeaways

Do EU regulators have a target percentage of sessions and clicks they want to see from Places Sites? Do they have a percentage of sessions in mind that lead to non-Google clicks? Without knowing whether such targets exist, let alone knowing what they are, we can't definitively say whether the Places Sites module and other changes put Google in full DMA compliance or not.

Based on its lack of impact on consumer behavior, Places Sites may as well not exist. It drives almost no engagement, even above the fold. GBP still drives the plurality of engagements for desktop searchers and the majority of engagements for mobile searchers.

The median consumer will almost always default to an engagement with the Local Pack if it's visible as part of their search experience. From that standpoint it would appear Google is still "self-preferencing."